Darren Krett

Wednesday 7 June 2023

CALL OPTIONS

0

Comments (0)

Stay ahead and keep your mind focused.

Categories

Learning

Option Strategies

This structure can simply be described as tying off the open ended risk involved in a Call spread 1x2.

In the Call spread 1x2 example of the 100/125 Call 1x2, we would just buy an additional Call above our 2 short 125 Calls.

Any strike above it would work, but let’s keep it equidistant for discussion and do the 100/125/150 Call Butterfly.

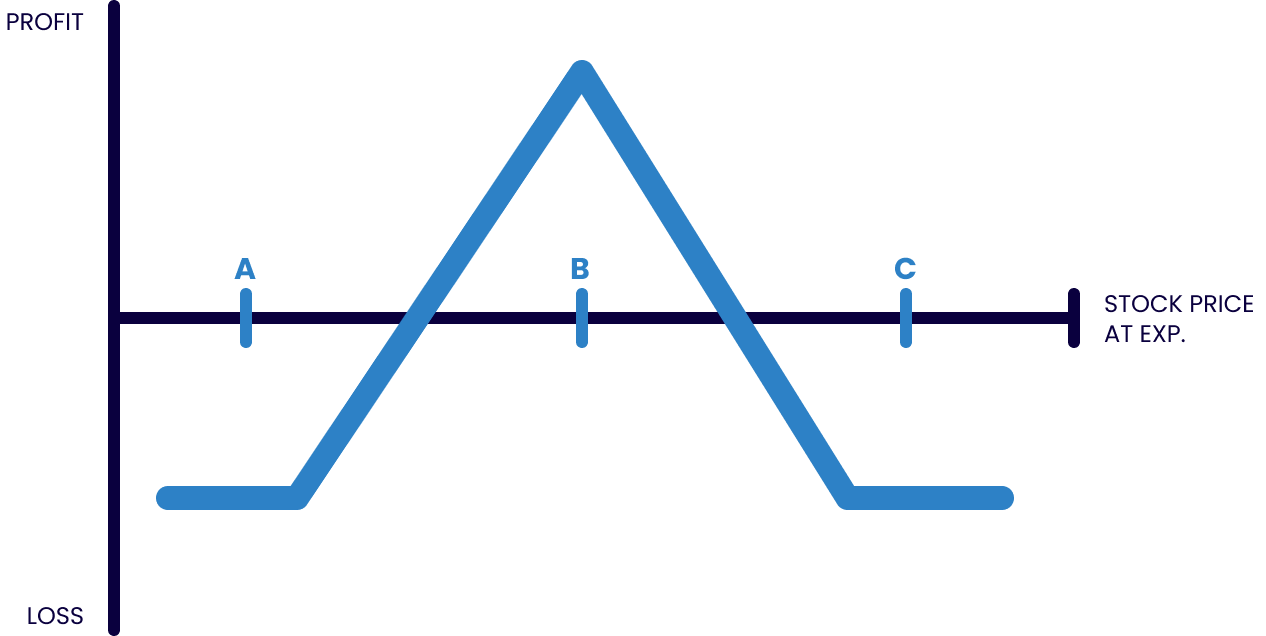

The end structure would be long 1x the 100 Call/short 2x the 125 Call/long 1x the 150 Call. The Max profit is same as that of a Call spread, the Strike differential less the premium paid for the structure. By adding the upper Call, the Max Loss is now limited to the Premium paid for the Butterfly. The great thing about the equidistant Call Fly is it is usually very cheap to purchase. The bad things are that is doesn’t usually pick up in price until expiration nears and it is very hard to pick an exact target price. If you buy a 100/125/150 Call Fly for $5, your break evens are 105 to 145.

That is a nice wide landing zone, but if the market lands outside of 105 to 145, you start losing your premium paid.

and here is ytour Profit and Loss expiration graph;

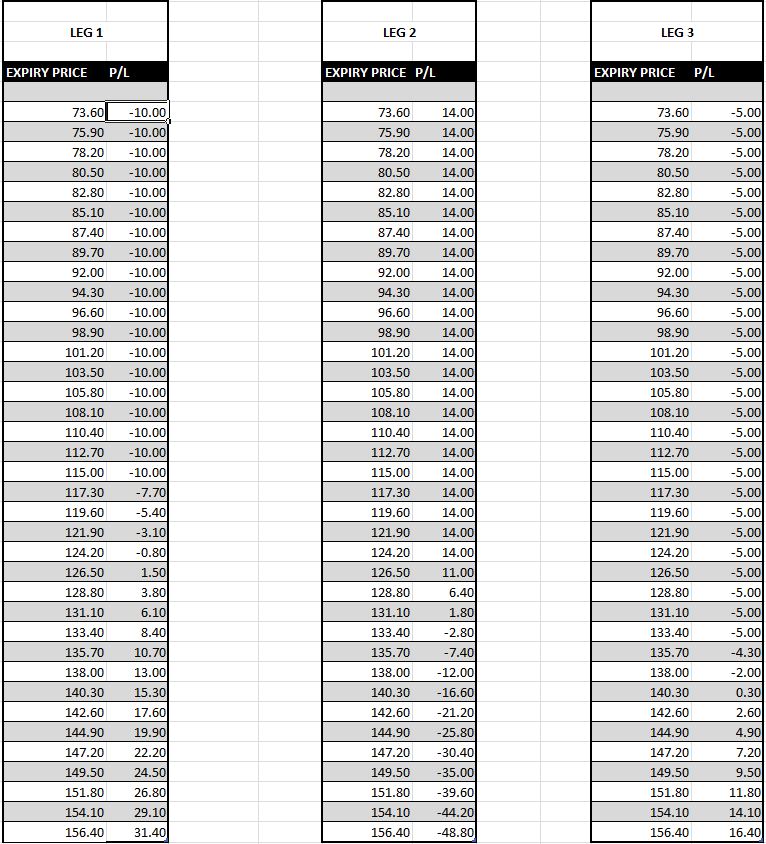

Throughout the learning section I will advise you to manually do an expiration Profit & Loss table. This allows you to visualize exactly what it is that you are doing and is something all beginner traders do to start learning about strategies.

YOU then just need to work out each individual leg profit and loss then net it out in a graph

Darren Krett

Wednesday 7 June 2023

0

Comments (0)

Darren Krett

Thursday 8 June 2023

0

Comments (0)

Get ahead of the wave and sign up to our socials to get access to exclusive offers, videos, tutorials and latest news.

© 2015 - 2026 Leviathan Financial Management LLC. All Rights Reserved.

Legal Disclaimer: The information provided in the Leviathan website is for informational purposes only. It should not be considered legal or financial advice. You should consult with a financial advisor professional to determine what may be best for your individual needs. Leviathan Financial Management does not make any guarantee or other promise as to any results that may be obtained from using our content. No one should make any investment decision without first consulting his or her own financial advisor and conducting his or her own research and due diligence. To the maximum extent permitted by law, Leviathan Financial Management disclaims any and all liability in the event any information, commentary, analysis, opinions, advice and/or recommendations prove to be inaccurate, incomplete or unreliable, or result in any investment or other losses. Content contained on or made available through the website is not intended to and does not constitute legal advice or investment advice. Your use of the information on the website or materials linked from the Web is at your own risk.