Tyler Krett

Wednesday 14 December 2022

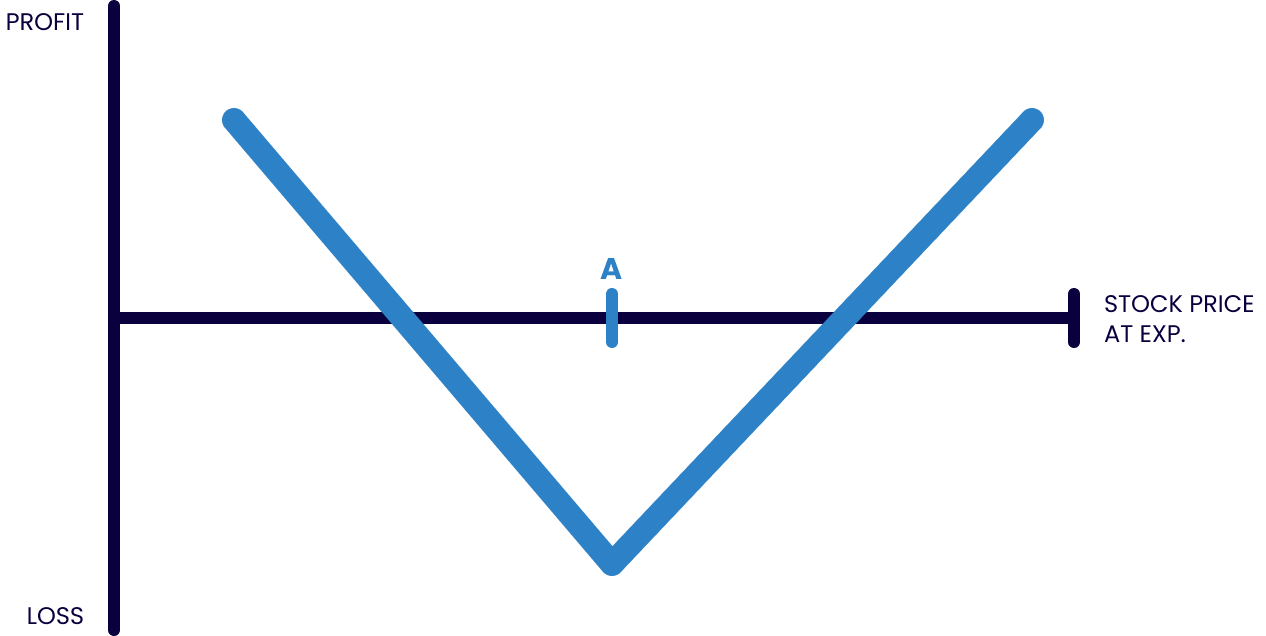

Short Straddle

0

Comments (0)

Stay ahead and keep your mind focused.

Categories

Learning

The Setup

Buy a call, strike price A

Buy a put, strike price A

Generally, the stock price will be at strike A

A long straddle is the best of both worlds, since the call gives you the right to buy the stock at strike price A and the put gives you the right to sell the stock at strike price A. But those rights don’t come cheap.

The goal is to profit if the stock moves in either direction. Typically, a straddle will be constructed with the call and put at-the-money (or at the nearest strike price if there’s not one exactly at-the-money). Buying both a call and a put increases the cost of your position, especially for a volatile stock. So you’ll need a fairly significant price swing just to break even.

Advanced traders might run this strategy to take advantage of a possible increase in implied volatility. If implied volatility is abnormally low for no apparent reason, the call and put may be undervalued. The idea is to buy them at a discount, then wait for implied volatility to rise and close the position at a profit.

Tyler Krett

Wednesday 14 December 2022

0

Comments (0)

Tyler Krett

Wednesday 14 December 2022

0

Comments (0)

Get ahead of the wave and sign up to our socials to get access to exclusive offers, videos, tutorials and latest news.

© 2015 - 2024 Leviathan Financial Management LLC. All Rights Reserved.

Legal Disclaimer: The information provided in the Leviathan website is for informational purposes only. It should not be considered legal or financial advice. You should consult with a financial advisor professional to determine what may be best for your individual needs. Leviathan Financial Management does not make any guarantee or other promise as to any results that may be obtained from using our content. No one should make any investment decision without first consulting his or her own financial advisor and conducting his or her own research and due diligence. To the maximum extent permitted by law, Leviathan Financial Management disclaims any and all liability in the event any information, commentary, analysis, opinions, advice and/or recommendations prove to be inaccurate, incomplete or unreliable, or result in any investment or other losses. Content contained on or made available through the website is not intended to and does not constitute legal advice or investment advice. Your use of the information on the website or materials linked from the Web is at your own risk.