Darren Krett

Tuesday 23 January 2024

OPTION PLAYS FOR TESLA EARNINGS

0

Comments (0)

cuong.nguyen

Monday 12 May 2025

Share on:

Post views: 2330

Categories

Blog

Alright everyone listen up. In the wake of recent economic news (trade deal agreements and reprieve from tariffs) the market is set to grow and potentially even boom, this being said, I have a trade for you ambitious bulls out there.

This trade is on the good old and trusted S&P 500, which has taken quite a hit since Trump’s liberation day tariffs went into effect.

Recent developments show that the US has reached trade deals with the UK and China, reducing our tariffs on Chinese imports to 30% for 90 days, which will likely lead to a bull run in the markets.

That being said, for you ambitious bulls who predict a large upswing, we are targeting the S&P 500 with a strike of 6100. We know you all sometimes like 0DTE options, which is too much of a risk in our books, but we have this one with a two-week expiration, so it still monetizes quickly, but allows more room for error.

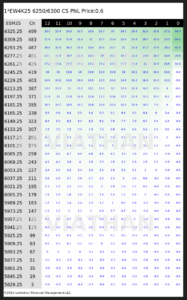

This trade is a 6250/6300 Call Spread, expiring week 4 of May, meaning there’s two weeks till expiration from today.

The cost of this trade is just slightly above average, but still overall cheap and well within the ideal range we are looking for.

The price of the underlying(S&P 500) is down from its February all time high, but is recovering nicely and is positioned to surge based on recent news. Due to this, we see value in buying calls at its current price.

The heatmap of this trade is one that I personally like a lot. I like this one because it shows how quickly and how much it monetizes. For this trade, being a call spread with a short expiration, it is in the money immediately upon a positive price movement. While this specific trade is on the more ambitious side and needs to go up a lot, market indications show it is positioned to do so, making this a perfect opportunity to make a ton of money with minimal downside risk.

In conclusion, recent news positioned the S&P 500 to grow. This allows a great opportunity for bullish investors to make money, assuming the right strategy is used. With this short call spread, investors are able to capitalize on positive movement and make up to $49.8 per contract that costs only 0.2c to buy. Don’t get caught behind this potential bull run and put yourself in a position to make some real money.

And as always, it’s better to be lucky than good, so good luck to you all.

Darren Krett

Tuesday 23 January 2024

0

Comments (0)

Darren Krett

Wednesday 31 January 2024

0

Comments (0)