Closing Report

Darren Krett

Wednesday 3 May 2023

END OF DAY REPORT MAY 3rd

FED raises rates 25bp, as expected and nobody really cared and yet the market still prices in a cut by September

END OF DAY REPORT MAY 3rd

0

Comments (0)

Darren Krett

Tuesday 16 May 2023

Share on:

Categories

closing report

Fed's Barkin (2024 voter) says demand is cooling but not yet cold, via Bloomberg; still looking to be convinced on inflation Fed still has optionality. Deposit flows are stable in his district (Richmond). Encouraged by the resilience seen in banks. Labour market is not red hot but it's still hot. He expects his unemployment rate forecast to come down a bit. IF more increases are needed to bring down inflation, then he is comfortable with that. One of the lessons Richmond Fed has learned is not to back away too soon. Fed's Barr says agency is considering stricter rules on accounting for unrealised losses for banks over USD 100bln in assets Fed Vice Chair of Supervision Barr says he expects to be able to present thinking on the Fed's holistic capital review by this summer Fed Vice Chair of Supervision Barr says he expects to be able to present thinking on the Fed's holistic capital review by this summer Fed's Williams (voter) says economy facing unacceptably high inflation; economy starting to get back to more normal patterns, with demand and supply moving back into balance, while inflation is moving gradually in the right direction Expects the economy to continue to grow this year. Takes a while for Fed decisions to fully affect the economy US President Biden said had a good, productive meeting on the debt ceiling and there is still more work to do, while he made clear to House Speaker McCarthy that they will talk regularly over the next several days

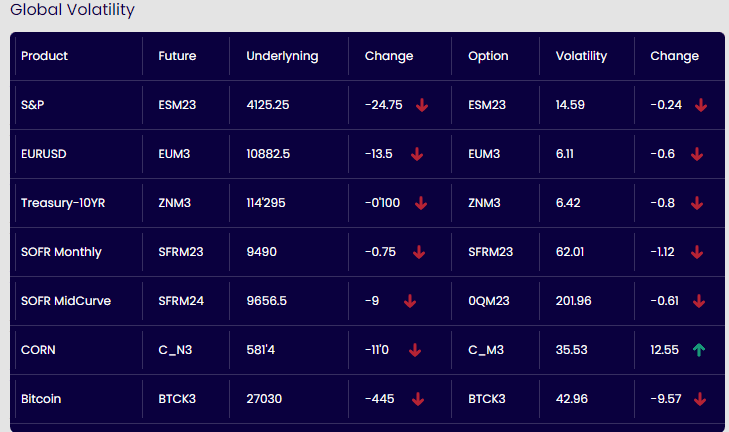

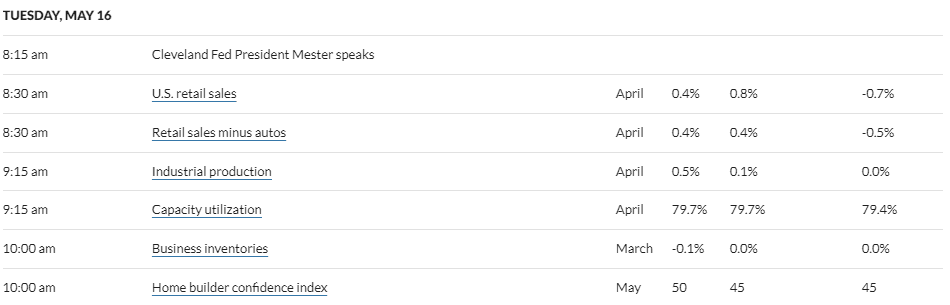

It was a risk off session with the majority of stocks and indices in the red with the only pockets of strength in Tech and large-cap names. Overall economic data was mixed, China data signalled a slower-than-expected rebound from the re-opening while US retail sales data was net positive with a headline miss, in line core prints but a strong control group. Meanwhile, US Industrial production and manufacturing output were above expectations. There was plenty of Fed speak again, non-voter Mester was hawkish saying she doesn't feel the Fed are at a sufficiently restrictive level yet, while Logan (voter) was more dovish warning of financial stability risks and speaking of the need to travel more slowly in an uncertain environment while others repeated familiar themes. Debt ceiling talks are ongoing but after the Congressional leaders meeting with Biden, McCarthy spoke on the closing bell and said it is possible to get a deal by the end of the week but they are still far apart while Schumer said the meeting was good and productive.

Darren Krett

Wednesday 3 May 2023

0

Comments (0)

Darren Krett

Tuesday 9 May 2023

0

Comments (0)