Darren Krett

Monday 19 February 2024

Option Plays for NVIDIA earnings and beyond

0

Comments (0)

cuong.nguyen

Tuesday 27 May 2025

Share on:

Post views: 2315

Categories

Blog

Greetings everyone,

We open this holiday week on the positive side in the US markets, as they seek to make back Friday losses. Along with this, we have the much-anticipated earnings reports coming from Nvidia after market close on Wednesday. Nvidia has been a highly volatile equity as of recent, being very susceptible to swings in consumer sentiment and news, specifically regarding tariffs. Based on the uptick of investment in the US and what looks to be a pause in many tariffs, I believe Nvidia to be undervalued and have a lot of room on the positive side to grow, but I am fearful because one wrong tweet could send it the opposite direction. For these reasons, we targeted strikes on both the positive and negative side, them being 160 and 110. Our 160 strike comes from the prediction of Vivek Arya from BofA, and our 110 strike is based on the 120 prediction from HSBC.

First, for you bulls on there, the best trade we found on the positive side is a 150/160 Call Spread, expiring in August.

The cost of this trade is well below its historical average, giving investors lots of value for a relatively cheap premium.

The cost of this trade is well below its historical average, giving investors lots of value for a relatively cheap premium.

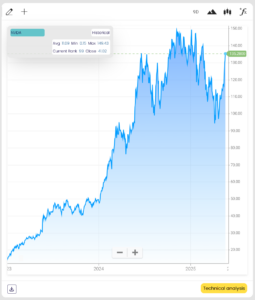

The price of the underlying equity, (NVDA), is near its recent highs, but has not made back the losses it suffered since reaching its peak in January 25. The price has been very reactive to tariff news and mixed consumer sentiment but is a strong company with strong underlying value.

The price of the underlying equity, (NVDA), is near its recent highs, but has not made back the losses it suffered since reaching its peak in January 25. The price has been very reactive to tariff news and mixed consumer sentiment but is a strong company with strong underlying value.

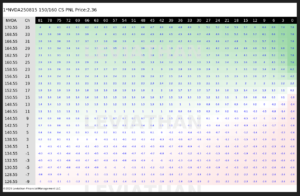

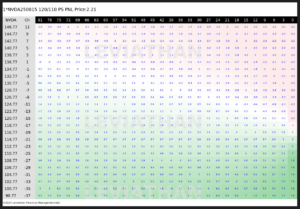

The heatmap of this trade shows its profitability, and in this one we can see it monetizes quickly, and has very limited downside risk. We look for trades that are risk limited to premium only, as we want to ensure we are protected in case we’re wrong. That being said, the heatmap shows us this is a profitable trade with minimal risk, meaning it is ideal for what we’re looking for.

The heatmap of this trade shows its profitability, and in this one we can see it monetizes quickly, and has very limited downside risk. We look for trades that are risk limited to premium only, as we want to ensure we are protected in case we’re wrong. That being said, the heatmap shows us this is a profitable trade with minimal risk, meaning it is ideal for what we’re looking for.

On the flip side, for you bears out there (not super popular with this one but I know you exist), we found a 120/110 Put Spread, also expiring in August.

On the flip side, for you bears out there (not super popular with this one but I know you exist), we found a 120/110 Put Spread, also expiring in August.

The cost of this trade is also slightly below average, giving investors strong value and high upside potential, for a cheap premium cost.

The cost of this trade is also slightly below average, giving investors strong value and high upside potential, for a cheap premium cost.

The heatmap of this trade shows profitability, and being spread it is ideal in our eyes, because it monetizes immediately, has very limited risk (premium only) and hefty returns if the price of NVDA goes down.

The heatmap of this trade shows profitability, and being spread it is ideal in our eyes, because it monetizes immediately, has very limited risk (premium only) and hefty returns if the price of NVDA goes down.

In conclusion, Nvidia earnings comes out Wednesday after market close. There is much uncertainty around this between tariffs and China’s regulations, But Nvidia itself is a strong company with lots of room to grow. It is impossible for me to say which way it will move, as no one truly knows that, but with these trades, if you are confident in your analysis and believe in your position with conviction, there is much money to be made.

In conclusion, Nvidia earnings comes out Wednesday after market close. There is much uncertainty around this between tariffs and China’s regulations, But Nvidia itself is a strong company with lots of room to grow. It is impossible for me to say which way it will move, as no one truly knows that, but with these trades, if you are confident in your analysis and believe in your position with conviction, there is much money to be made.

And as always, it’s better to be lucky than good so good luck to you all.

Darren Krett

Monday 19 February 2024

0

Comments (0)

Darren Krett

Tuesday 25 April 2023