cuong.nguyen

Tuesday 29 April 2025

Option Plays for META Earnings and Beyond

0

Comments (0)

cuong.nguyen

Wednesday 30 April 2025

Share on:

Post views: 5279

Categories

Blog

Continuing this busy week of economic and earnings reports, one of the sexier ones to watch out for is from Amazon. TBH I am bearish of the market overall, but also from a chart perspective is still looks fairly constructive, so I will leave the call of whether we go up or down , to you…I will just present you with the best option strategy for both bullish and bearish scenarios.

First, for you bulls out there, who are looking to profit upon good news and a good reaction, looking to target a strike of 210. The best trade we found for this situation is a 200/220 Call Spread, expiring in June.

The cost of this trade is on the higher end, historically speaking, but definitely still within the ideal range. I like call (BULL) spreads because it monetizes quickly, so even if your view is slightly longer term to capture the trend, you can get some decent return from an initial knee-jerk reaction too.

The cost of this trade is on the higher end, historically speaking, but definitely still within the ideal range. I like call (BULL) spreads because it monetizes quickly, so even if your view is slightly longer term to capture the trend, you can get some decent return from an initial knee-jerk reaction too.

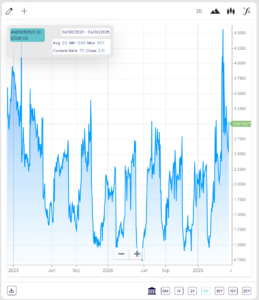

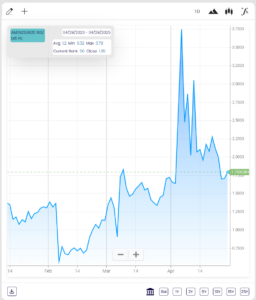

The value of the underlying equity, AMZN, is down from its February high, but still strong and poised to bounce back upwards (depending on the earnings report.)

The value of the underlying equity, AMZN, is down from its February high, but still strong and poised to bounce back upwards (depending on the earnings report.)

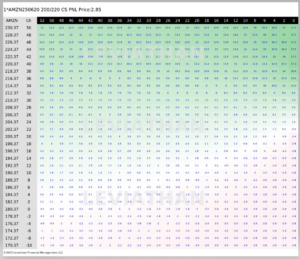

The heatmap of the trade shows why we like it so much. It is immediately profitable, even far from expiration, on a positive move in the underlying. Additionally, it also shows the downside, and how risk is limited to the premium, thus protecting investors from potentially huge losses…you care capped, you know what your downside is.

The heatmap of the trade shows why we like it so much. It is immediately profitable, even far from expiration, on a positive move in the underlying. Additionally, it also shows the downside, and how risk is limited to the premium, thus protecting investors from potentially huge losses…you care capped, you know what your downside is.

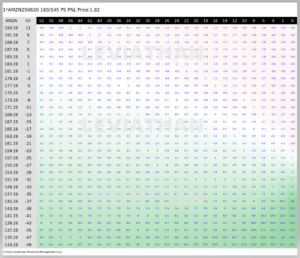

On the bearish side, we found two different trades. The first is for investors looking to be in the money right away, as this one shows profits throughout the duration of the contract, beginning immediately, if the underlying(AMZN) decreases in value. This trade is a 160/145 Put Spread, expiring in June.

On the bearish side, we found two different trades. The first is for investors looking to be in the money right away, as this one shows profits throughout the duration of the contract, beginning immediately, if the underlying(AMZN) decreases in value. This trade is a 160/145 Put Spread, expiring in June.

The cost of this trade is less than what it would have been for most of April, but historically slightly above average.

The cost of this trade is less than what it would have been for most of April, but historically slightly above average.

The heatmap of this trade shows the immediate profitability upon a downward move in the underlying, while also showing the downside risk is limited only to the premium paid for the trade.

The heatmap of this trade shows the immediate profitability upon a downward move in the underlying, while also showing the downside risk is limited only to the premium paid for the trade.

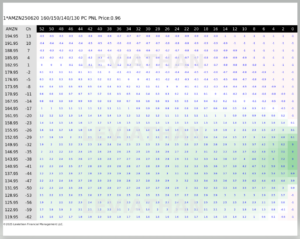

The next trade we found is a 160/150/140/130 Put Condor

The next trade we found is a 160/150/140/130 Put Condor

The cost of this trade is cheaper than the previous one, but still offers strong potential value with very limited downside risk, which once again is only the premiums paid

The cost of this trade is cheaper than the previous one, but still offers strong potential value with very limited downside risk, which once again is only the premiums paid

The heatmap of this trade shows that it takes more time for an investor to reach ideal profit levels, but it still offers similar returns as the previous trade, while being much cheaper.

The heatmap of this trade shows that it takes more time for an investor to reach ideal profit levels, but it still offers similar returns as the previous trade, while being much cheaper.

In conclusion, Amazon’s earnings report is highly anticipated and ripe for the start of a new trend, choose your direction and place your trade and hope the earnings news does the rest.

And as always, it’s better to be lucky than good so good luck to you all

In conclusion, Amazon’s earnings report is highly anticipated and ripe for the start of a new trend, choose your direction and place your trade and hope the earnings news does the rest.

And as always, it’s better to be lucky than good so good luck to you all

cuong.nguyen

Tuesday 29 April 2025

0

Comments (0)

cuong.nguyen

Thursday 17 April 2025

0

Comments (0)