Darren Krett

Sunday 3 March 2024

Option plays for GitHub (GTLB) earnings and beyond

0

Comments (0)

Darren Krett

Tuesday 9 April 2024

Share on:

Post views: 12177

Categories

Blog

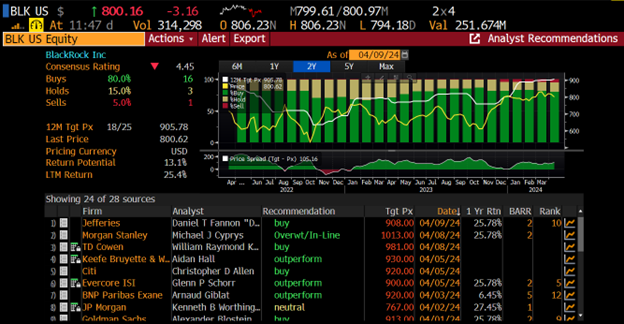

Blackrock…with quite a lot of analysts still considering this stock a buy, we should be able to look at 2 scenarios for this given the chart is looking a bit tired

But lets start off with the downside

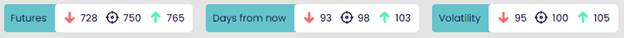

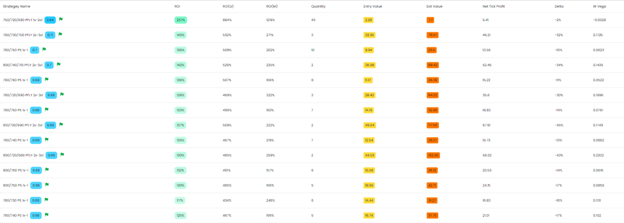

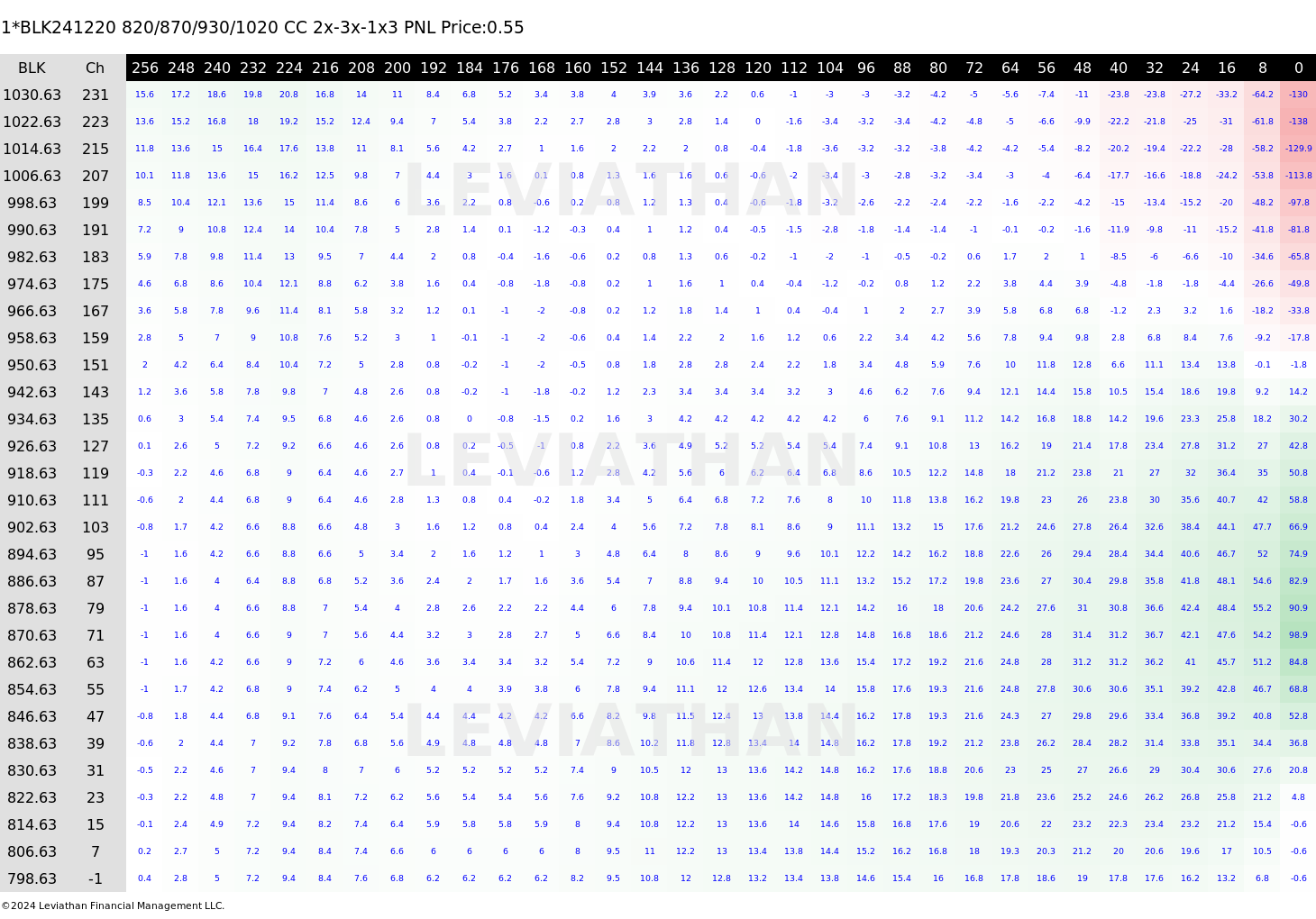

I like the put fly that comes in at the top of the vanilla list

I like the put fly that comes in at the top of the vanilla list

In at $2.25 and out at $7.70..now with this fly I may have to wait a bit to see some real returns on this, but having said that a move down straight after the earnings release then it will still monetize pretty well

In at $2.25 and out at $7.70..now with this fly I may have to wait a bit to see some real returns on this, but having said that a move down straight after the earnings release then it will still monetize pretty well

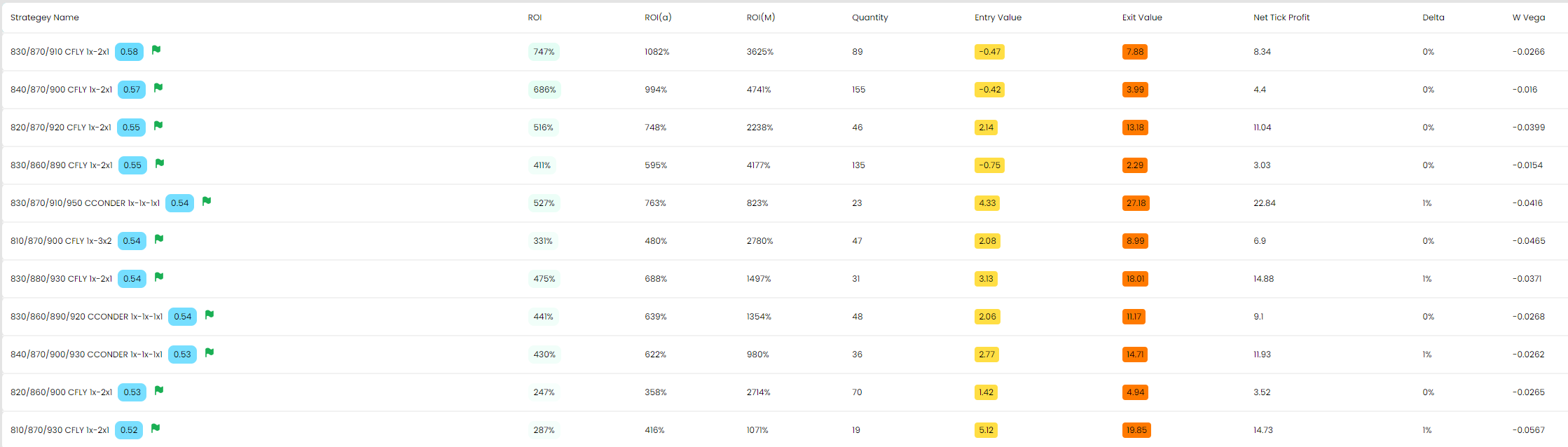

For the upside, I am going to go with Goldman's target price of $913, given that’s kind of in the middle of most on the list while at the same time giving myself plenty of wiggle room given that its an end of year target.

For the upside, I am going to go with Goldman's target price of $913, given that’s kind of in the middle of most on the list while at the same time giving myself plenty of wiggle room given that its an end of year target.

Well…I seem spoilt for choice on this scenario

Well…I seem spoilt for choice on this scenario

Now although the return on the top pick is enormous, it does also come with a little risk

Now although the return on the top pick is enormous, it does also come with a little risk

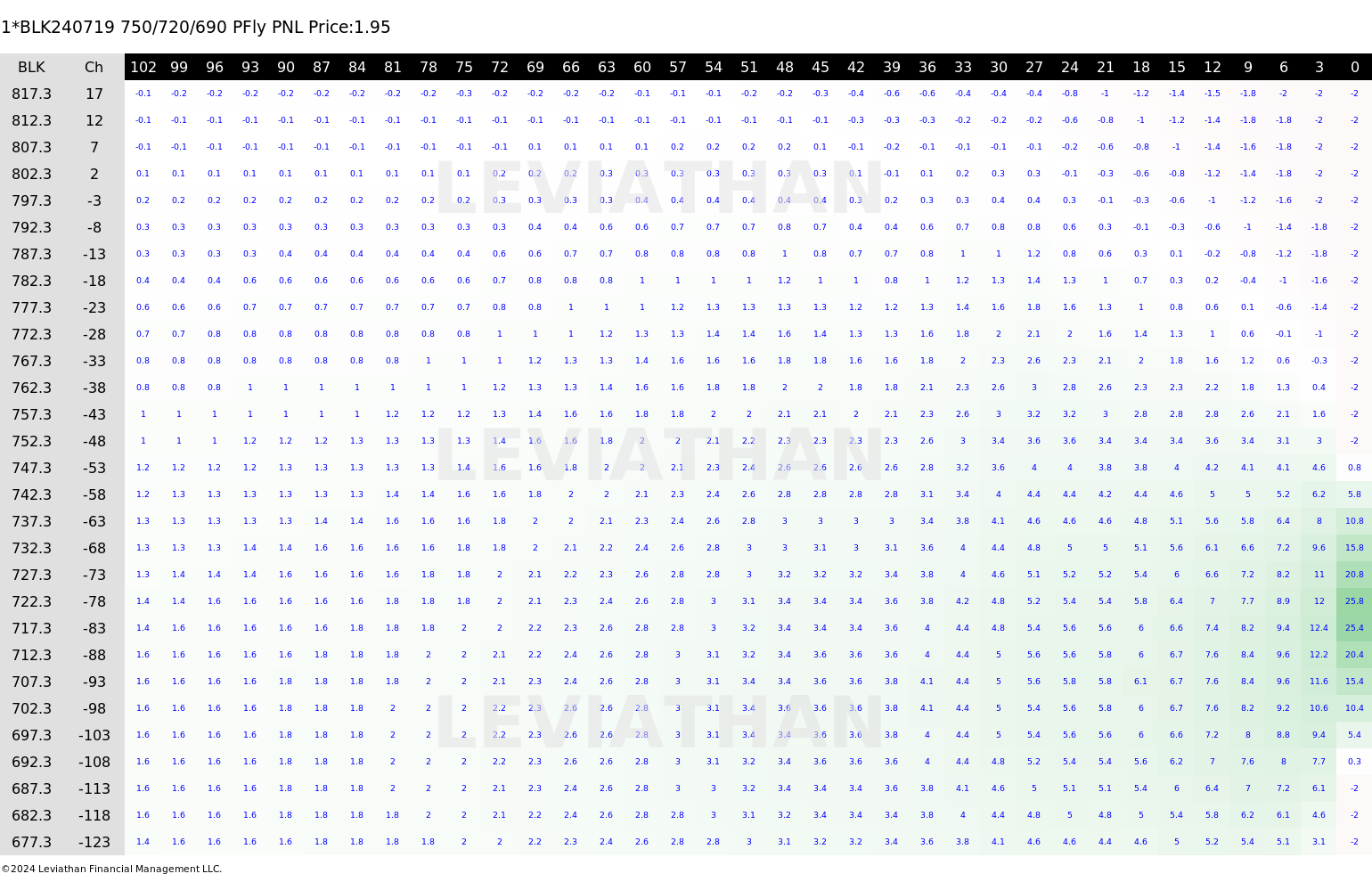

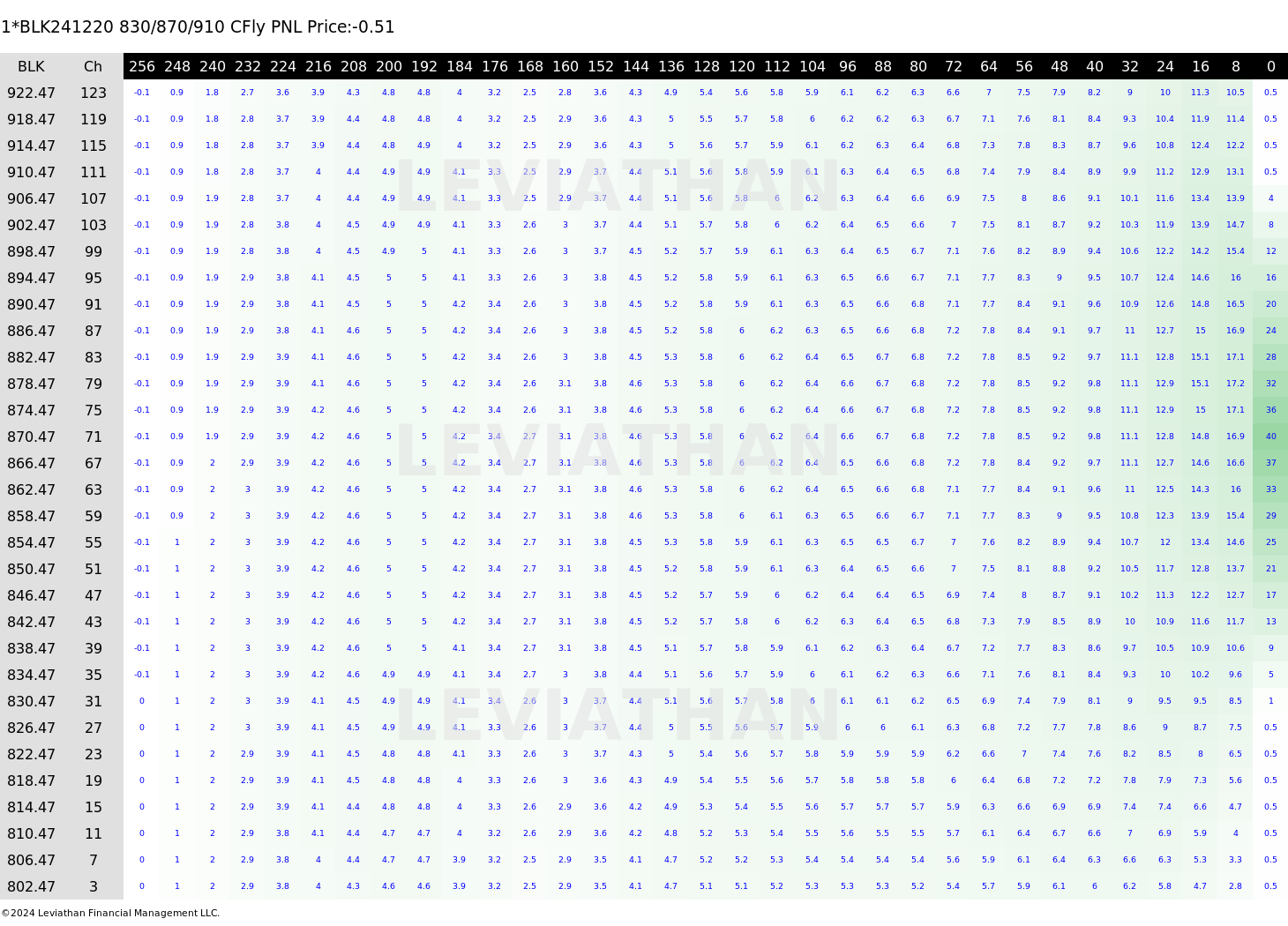

It will do very well if we go there quickly , but hold it too long and as you can see here, the top right of this heatmap would be painful…but as always, we are reminded that we are NOT looking to run this to expiration anyway.

It will do very well if we go there quickly , but hold it too long and as you can see here, the top right of this heatmap would be painful…but as always, we are reminded that we are NOT looking to run this to expiration anyway.

For those a little more risk adverse , then look at this one on the vanilla list

For those a little more risk adverse , then look at this one on the vanilla list

And this one, although not showing as large a return, is still very good and with less potential downside

And this one, although not showing as large a return, is still very good and with less potential downside

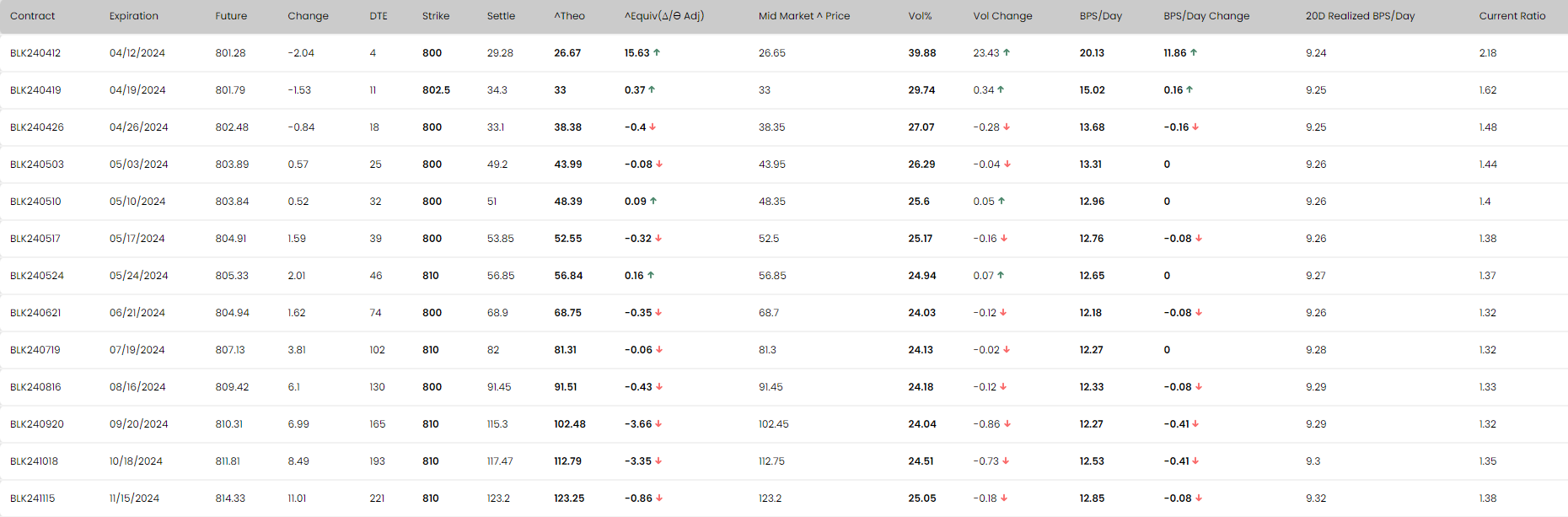

So we are expecting a $20 range for the earnings compared to $13 normally. So just a 2.5% move expected for the upcoming earnings

So we are expecting a $20 range for the earnings compared to $13 normally. So just a 2.5% move expected for the upcoming earnings

So there you have it

So there you have it

A July expiration downside trade and an end-of-year upside trade.

Good luck everyone and remember it is always better to be lucky than good!

Darren Krett

Sunday 3 March 2024

0

Comments (0)

Darren Krett

Wednesday 20 March 2024

0

Comments (0)