cuong.nguyen

Thursday 17 April 2025

Option plays for Lockheed Martin earnings and beyond....

0

Comments (0)

cuong.nguyen

Tuesday 29 April 2025

Share on:

Post views: 13030

Categories

Blog

Another big earnings report coming out this week, is META. Their earnings report comes after market close on Wednesday, so you have ample opportunity to put on one of my suggestions. Whether you are bullish or bearish that is for you individually to decide, but here I will provide the best risk/reward option strategy for each way.

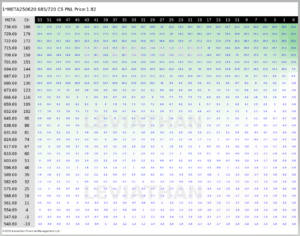

First, on the bullish side, we have a 685/720 Call Spread, expiring in June

The cost of this trade, historically, is slightly more expensive, sitting in the 66th percentile, however this could indicate the market expects a move in the positive direction

The cost of this trade, historically, is slightly more expensive, sitting in the 66th percentile, however this could indicate the market expects a move in the positive direction

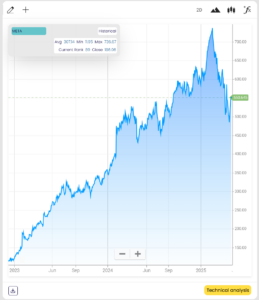

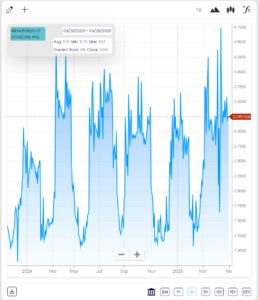

The price of the underlying equity, META, is relatively high, but also a well down from its February high. It is easy for bullish investors to find value at this discounted cost

The price of the underlying equity, META, is relatively high, but also a well down from its February high. It is easy for bullish investors to find value at this discounted cost

The heatmap of this trade shows profitability, while also demonstrating that the downside is limited to premium only, drastically minimizing downside risk

The heatmap of this trade shows profitability, while also demonstrating that the downside is limited to premium only, drastically minimizing downside risk

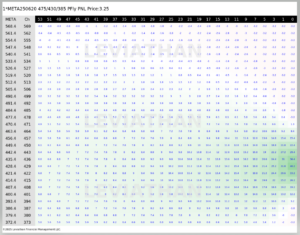

A bearish investor may predict a weak earnings report, and thus a decrease in the value of the underlying equity and want to profit on this downturn. A great trade in that situation is a 475/430/385 Put Fly, also expiring in June

A bearish investor may predict a weak earnings report, and thus a decrease in the value of the underlying equity and want to profit on this downturn. A great trade in that situation is a 475/430/385 Put Fly, also expiring in June

The cost of this trade is also on the higher side, sitting in the 69th percentile, however the downside is limited to only the premium, making it relatively save when it comes to options trades.

The cost of this trade is also on the higher side, sitting in the 69th percentile, however the downside is limited to only the premium, making it relatively save when it comes to options trades.

The heatmap of this trade shows the profitability depending on how the underlying equity(META) moves, and this one shows strong returns with very limited risk, due to the downside being limited to premium only, one of the many options traders can choose when using our software.

The heatmap of this trade shows the profitability depending on how the underlying equity(META) moves, and this one shows strong returns with very limited risk, due to the downside being limited to premium only, one of the many options traders can choose when using our software.

In conclusion, whether META stock moves up or down, there is plenty of money to be made. We cannot tell you which direction it will go, rather we provide the best trades on both sides to maximize profits while limiting downside risk.

And as always, its better to be lucky than good so, good luck…

In conclusion, whether META stock moves up or down, there is plenty of money to be made. We cannot tell you which direction it will go, rather we provide the best trades on both sides to maximize profits while limiting downside risk.

And as always, its better to be lucky than good so, good luck…

cuong.nguyen

Thursday 17 April 2025

0

Comments (0)

Darren Krett

Wednesday 31 January 2024

0

Comments (0)