Darren Krett

Sunday 4 February 2024

Option plays for PLTR earnings

0

Comments (0)

cuong.nguyen

Friday 2 May 2025

Share on:

Post views: 3196

Categories

Blog

Going into the weekend, we are looking forward to next week’s earnings reports. One of your favorites, coming out after close on Monday, comes from Palantir(PLTR).

You’ll be pleased to know that its been showing steady growth despite current non-ideal economic conditions. Personally, I cannot predict which way it will move based on earnings, as it is just shy of its February all time high, but continues to perform. Tbh there is a case to be made for movement in either direction, so Ill leave that to each of you to decide for yourselves.

Most Wall Street Analysists predict PLTR to decrease over a 12 month span, with the average price prediction around 95. That being said, PLTR continues to perform well and with a positive earnings report, has plenty of room to increase in value. Plus, what does Wall Street know anyway, lol.

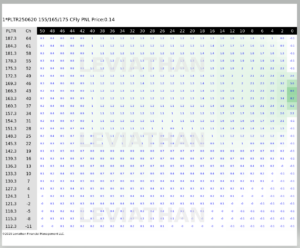

The trade we found for positive movement, is a 155/165/175 Call Fly, expiring in June

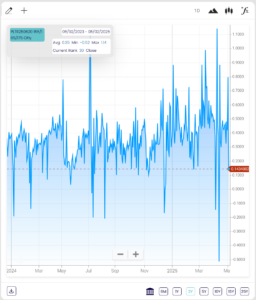

The cost of this trade is cheaper than its been for the most of the last couple years, giving investors fantastic value with strong upside potential

The cost of this trade is cheaper than its been for the most of the last couple years, giving investors fantastic value with strong upside potential

The cost of the underlying equity, PLTR stock is just a hair shy of its February all time high. While they have a lot of room for growth, it is easy for a bearish investor to see value in the downside, especially considering the state of the US and world economy amidst tariff uncertainty.

The cost of the underlying equity, PLTR stock is just a hair shy of its February all time high. While they have a lot of room for growth, it is easy for a bearish investor to see value in the downside, especially considering the state of the US and world economy amidst tariff uncertainty.

The heatmap of this trade shows the profitability, which shows a large range where the trade is profitable, while also showing downside risk is limited to just the premium paid.

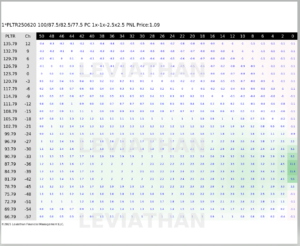

On the flip side, for you bears out there, many Wall Street Analysts have a 12 month prediction of 93.69. Using this and a strike of 90, we found the following trade, expiring June 20th.

On the flip side, for you bears out there, many Wall Street Analysts have a 12 month prediction of 93.69. Using this and a strike of 90, we found the following trade, expiring June 20th.

The trade generated is a 100/87.5/82.5/77.5 Put Condor, (1x-1x-2.5x2.5), with a suggested quantity of 72 contracts. Now, obviously we cannot trade half of a contract, so this trade in practicality becomes a 2x-2x-5x5 ratio trade, but with 36 contracts instead of 72.

The trade generated is a 100/87.5/82.5/77.5 Put Condor, (1x-1x-2.5x2.5), with a suggested quantity of 72 contracts. Now, obviously we cannot trade half of a contract, so this trade in practicality becomes a 2x-2x-5x5 ratio trade, but with 36 contracts instead of 72.

The cost of this trade is just slightly above average, but not unreasonably so and not outside of our ideal range

The heatmap of this trade shows the profitability, and while admittedly this is not as green as I would like, there are still plenty of positives. These include being in the money quickly assuming a downside move in the underlying, and a potential 10x return if the position is held till expiration and ends in the target zone of 81 to 90. Additionally, the risk is limited to premium cost only, meaning if you get the direction wrong you are not exposed to a large downside risk of movement, and rather are only out the premium you paid.

The heatmap of this trade shows the profitability, and while admittedly this is not as green as I would like, there are still plenty of positives. These include being in the money quickly assuming a downside move in the underlying, and a potential 10x return if the position is held till expiration and ends in the target zone of 81 to 90. Additionally, the risk is limited to premium cost only, meaning if you get the direction wrong you are not exposed to a large downside risk of movement, and rather are only out the premium you paid.

In conclusion, PLTR has been performing well, and beating most of the S&P 500. It has been an investor favorite, and has consistently done well over the past couple years. That being said, it is just about at it’s all time high right now, which reasonably can make investors wary to buy it or take a long position. There are compelling cases to be made for movement in either direction, and with me lacking my own crystal ball, I cannot say which direction it will move.

So, to all of you, do your research and determine which way your analysis predicts it to move, and place your trades accordingly.

And as always remember, it’s better to be lucky than good, so good luck to you all.

In conclusion, PLTR has been performing well, and beating most of the S&P 500. It has been an investor favorite, and has consistently done well over the past couple years. That being said, it is just about at it’s all time high right now, which reasonably can make investors wary to buy it or take a long position. There are compelling cases to be made for movement in either direction, and with me lacking my own crystal ball, I cannot say which direction it will move.

So, to all of you, do your research and determine which way your analysis predicts it to move, and place your trades accordingly.

And as always remember, it’s better to be lucky than good, so good luck to you all.

Darren Krett

Sunday 4 February 2024

0

Comments (0)

cuong.nguyen

Tuesday 29 April 2025

0

Comments (0)