cuong.nguyen

Tuesday 29 April 2025

Option Plays for META Earnings and Beyond

0

Comments (0)

cuong.nguyen

Thursday 1 May 2025

Share on:

Post views: 3886

Categories

Blog

LAST MINUTE OPTION PLAYS FOR AAPL EARNINGS AND BEYOND

Continuing our eventful week of earnings and government reports, another great opportunity for investors comes from Apple. Personally, it is so difficult to tell which way the underlying will move, as Apple is one of the strongest and best companies in the world(heck just about everyone I know has at least some type of Apple product), but with economic uncertainty in the US and risk of costs drastically rising from tariffs, its impossible to know what will happen. That being said, we still came up with the best options strategies for whichever way it moves, and this could be the opportunity YOU have been looking for.

Our goals were to limit downside risk, maximize potential profits(duh), and be in the money as soon as possible, rather than finding a trade that is only profitable near expiration. On this note, for you bulls out there, the first trade we found is a 250/270 Call Spread, expiring in June

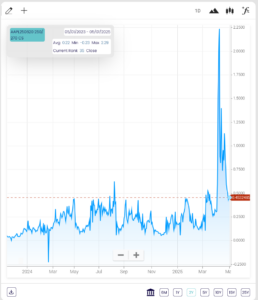

The cost of this trade is slightly higher than average over the past two years, but well cheaper than it’s been over the past month and a half, which I believe gives it quite good value

The cost of this trade is slightly higher than average over the past two years, but well cheaper than it’s been over the past month and a half, which I believe gives it quite good value

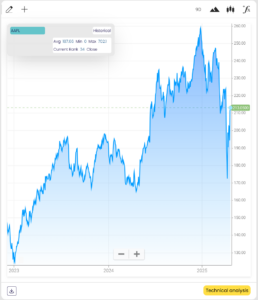

Similarly to many of the leading US equities, the cost of the underlying is high compared to the past couple years, but also well below its recent February high. The implications of this are for each investor to determine themselves, but there is a case to be made for movement in either direction.

Similarly to many of the leading US equities, the cost of the underlying is high compared to the past couple years, but also well below its recent February high. The implications of this are for each investor to determine themselves, but there is a case to be made for movement in either direction.

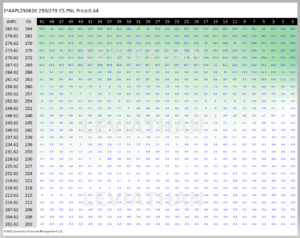

The heatmap of this trade shows the profitability probabilities, and we like this trade because it profits immediately on a positive movement in the underlying, while limiting downside risk to the cost of the premium only, making it a safe trade with the chance for very strong returns.

The heatmap of this trade shows the profitability probabilities, and we like this trade because it profits immediately on a positive movement in the underlying, while limiting downside risk to the cost of the premium only, making it a safe trade with the chance for very strong returns.

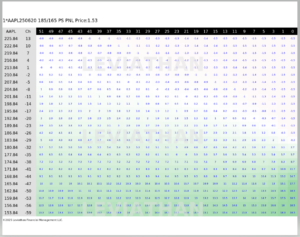

On this flip side, for you bears out there looking to profit on a downward move, we found a 185/165 Put Spread, also expiring in June

On this flip side, for you bears out there looking to profit on a downward move, we found a 185/165 Put Spread, also expiring in June

The cost of this trade is similar top the positive one, in the sense that it is slightly higher than it was historically, but also cheaper than it’s been over the past few weeks.

The cost of this trade is similar top the positive one, in the sense that it is slightly higher than it was historically, but also cheaper than it’s been over the past few weeks.

The heatmap of this trade shows the strong profitability of this trade, showing how it profits immediately upon a downward move of the underlying, while at the same showing how risk is limited to the cost of the premium, giving it a high return chance with minimal negative risk.

The heatmap of this trade shows the strong profitability of this trade, showing how it profits immediately upon a downward move of the underlying, while at the same showing how risk is limited to the cost of the premium, giving it a high return chance with minimal negative risk.

In conclusion, this is a time of uncertainty in the US and global markets. This creates opportunities for investors to capitalize on volatility and make serious money. While I do not have a crystal ball and cannot say which direction AAPL or any stock will move, we can and do provide the best trades to make for each side and leave it up to you.

In conclusion, this is a time of uncertainty in the US and global markets. This creates opportunities for investors to capitalize on volatility and make serious money. While I do not have a crystal ball and cannot say which direction AAPL or any stock will move, we can and do provide the best trades to make for each side and leave it up to you.

And remember, at the end of the day, it’s better to be lucky than good, so good luck to you all.

cuong.nguyen

Tuesday 29 April 2025

0

Comments (0)

cuong.nguyen

Wednesday 30 April 2025

0

Comments (0)