cuong.nguyen

Tuesday 29 April 2025

Option Plays for META Earnings and Beyond

0

Comments (0)

cuong.nguyen

Wednesday 30 July 2025

Share on:

Post views: 2102

Categories

Blog

META Earnings Jumping back into options plays on earnings reports, the next one we are looking at is META. While there is a lot of uncertainty in both the markets in general, and with META itself, there is plenty of room to make money. As Zuckerberg continues to make a big push into AI development and advancement, only time will tell if this tree bears fruit. Personally, I fall on the more bullish side, as I believe META’s AI development will be successful, and the market is in a bullish period now anyway, even though it sems a bit greedy.

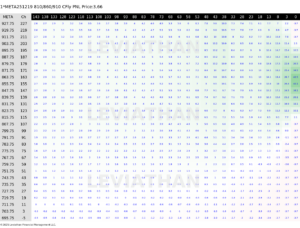

Bullish Play: First, looking at the bullish side, and based on expert analyst recommendations from both Canaccord and Jefferies, we are seeking a strike of 850. Based on this criteria, we found an 810/860/910 Call Fly, expiring in December.

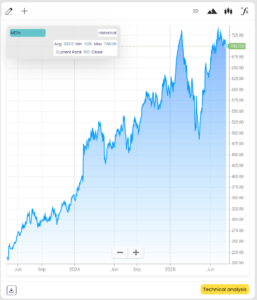

The historical price of META is just below its all-time high, but with the trends in the market, industry, and META’s own rapid advancement in the AI space, there is much room for continued growth.

The historical price of META is just below its all-time high, but with the trends in the market, industry, and META’s own rapid advancement in the AI space, there is much room for continued growth.

The cost of this trade is right along where it has been for the past two years, not an amazing deal but also certainly not overpriced.

The cost of this trade is right along where it has been for the past two years, not an amazing deal but also certainly not overpriced.

The heatmap of this trade shows its profitability likeliness, and this one shows a high likelihood of strong returns immediately. It shows how one does not need to hold this option until expiration to get a good return and can take their profits as they choose. Additionally, the risk of this trade is limited to premium only, protecting you from huge, unexpected losses.

The heatmap of this trade shows its profitability likeliness, and this one shows a high likelihood of strong returns immediately. It shows how one does not need to hold this option until expiration to get a good return and can take their profits as they choose. Additionally, the risk of this trade is limited to premium only, protecting you from huge, unexpected losses.

Bearish Play:

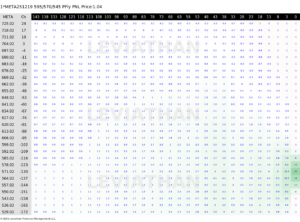

On the flip side, based on the analyst recommendation from Stephan Slowinski from BNP, we are seeking a strike of 575. Based on this, we found a 595/570/545 Put Fly, expiring in December.

The cost of this trade is right on par for where it has been over the past couple of years, giving good value and strong possible returns without breaking the bank.

The cost of this trade is right on par for where it has been over the past couple of years, giving good value and strong possible returns without breaking the bank.

The heatmap for this trade isn’t as broadly green as I personally would prefer, but it does offer strong returns over a wide range of prices and days, with minimal downside risk. It allows a trader the choice to take profits before expiration, or maintain the position to maximize gains, without risking a major loss.

The heatmap for this trade isn’t as broadly green as I personally would prefer, but it does offer strong returns over a wide range of prices and days, with minimal downside risk. It allows a trader the choice to take profits before expiration, or maintain the position to maximize gains, without risking a major loss.

In conclusion, META is a hot stock. The vast majority of expert analysts predict the price will increase, but at the end of the day, no one truly knows anything. Do your own analysis and determine where you believe the price will move, and either take these traders or use our tools to find the best trade possible for your own parameters and goals.

And always remember, it’s better to be lucky than good, so good luck to you all.

In conclusion, META is a hot stock. The vast majority of expert analysts predict the price will increase, but at the end of the day, no one truly knows anything. Do your own analysis and determine where you believe the price will move, and either take these traders or use our tools to find the best trade possible for your own parameters and goals.

And always remember, it’s better to be lucky than good, so good luck to you all.

cuong.nguyen

Tuesday 29 April 2025

0

Comments (0)

cuong.nguyen

Thursday 1 May 2025

0

Comments (0)