Tyler Krett

Wednesday 14 December 2022

Long combination/ Risk Reversal/ Combo (same strike)

0

Comments (0)

Tyler Krett

Wednesday 14 December 2022

Share on:

Post views: 30390

Categories

Option Strategies

Buying the put gives you the right to sell the stock at strike price A. Selling the call obligates you to sell the stock at strike price A if the option is assigned.

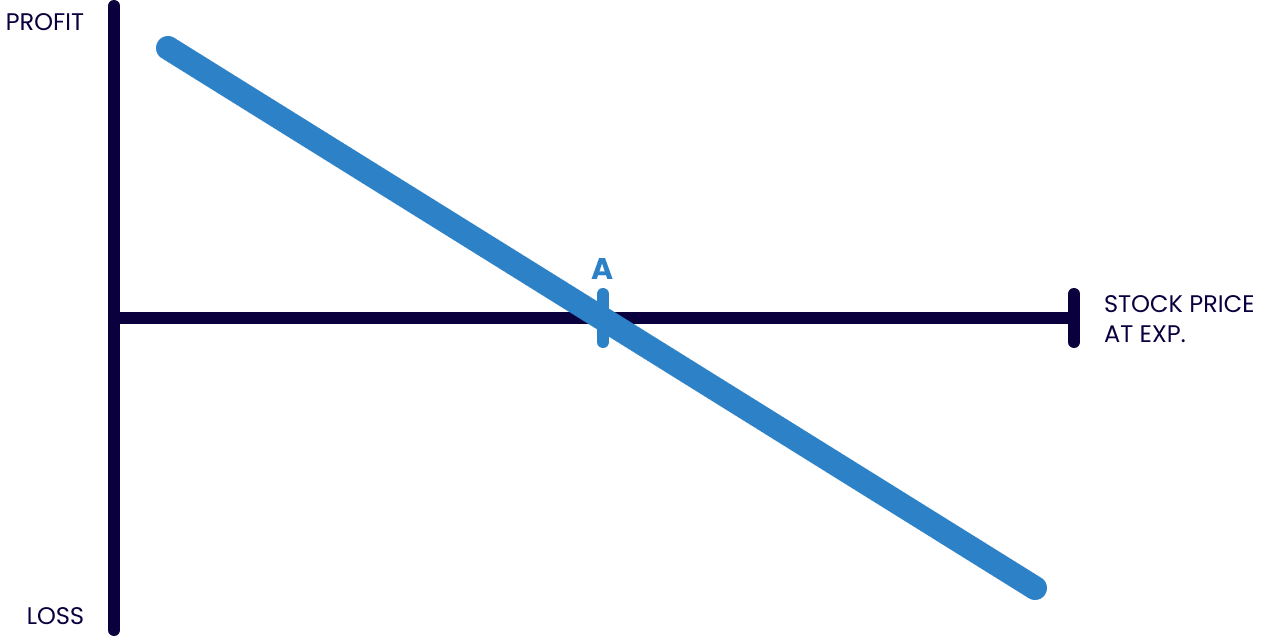

This strategy is often referred to as “synthetic short stock” because the risk / reward profile is nearly identical to short stock.

If you remain in this position until expiration, you are probably going to wind up selling the stock one way or the other. If the stock price is above strike A, the call will be assigned, resulting in a short sale of the stock. If the stock is below strike A, it would make sense to exercise your put and sell the stock. However, most investors who run this strategy don’t plan to stay in their position until expiration.

At initiation of the strategy, you will most likely receive a net credit, but you will have some additional margin requirements in your account because of the short call. However, those costs will be fairly small relative to the margin requirement for short stock. That’s the reason some investors run this strategy: to avoid having too much cash tied up in margin created by a short stock position.

Tyler Krett

Wednesday 14 December 2022

0

Comments (0)

Tyler Krett

Wednesday 14 December 2022

0

Comments (0)