Tyler Krett

Wednesday 14 December 2022

Strangle

0

Comments (0)

Tyler Krett

Wednesday 14 December 2022

Share on:

Post views: 38537

Categories

Option Strategies

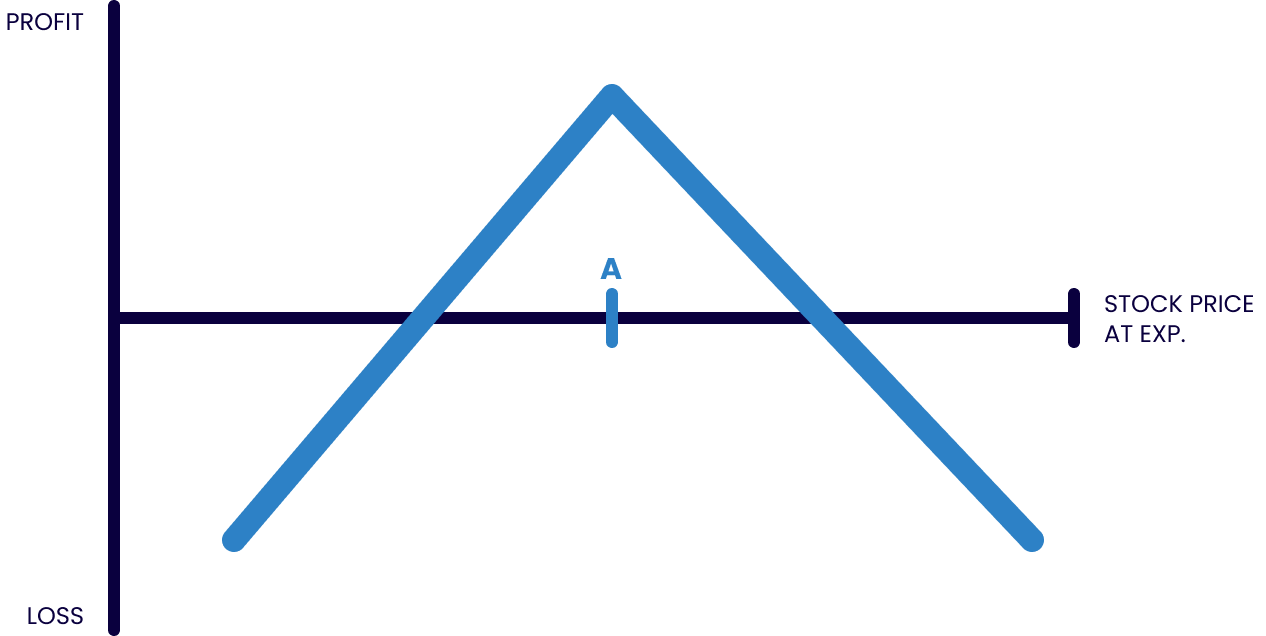

A short straddle gives you the obligation to sell the stock at strike price A and the obligation to buy the stock at strike price A if the options are assigned.

By selling two options, you significantly increase the income you would have achieved from selling a put or a call alone. But that comes at a cost. You have unlimited risk on the upside and substantial downside risk.

Advanced traders might run this strategy to take advantage of a possible decrease in implied volatility. If implied volatility is abnormally high for no apparent reason, the call and put may be overvalued. After the sale, the idea is to wait for volatility to drop and close the position at a profit

Setup:

Max Profit: Credit received from opening trade

How to Calculate Breakeven(s):

Implied volatility (IV) plays a huge role in our strike selection with straddles. The higher the IV, the more credit we will receive from selling the options. A higher credit ultimately means we will have wider breakeven points, since we can use the credit to offset losses we may see to the upside or downside. At the end of the day, a larger relative credit results in a higher probability of success with this strategy.

Other considerations:

Short straddle- a. Short both call and put at the same strike, same expiration b. Credit transaction-short straddle c. Limited reward, unlimited risk-short straddle d. 2 Breakevens Strike + total premium AND Strike total premium e. Maximum profit = limited to premium received short straddle f. Maximum loss = unlimited short straddle Other Considerations of Straddles: The theta (time decay) on an ATM straddle is the greatest in the last 3 days (negative on a long straddle and positive on a short straddle). The option volatility component (vega) is greater with more time, while the underlying volatility component (gamma) is greater with less time.

Tyler Krett

Wednesday 14 December 2022

0

Comments (0)

Tyler Krett

Wednesday 14 December 2022

0

Comments (0)