cuong.nguyen

Tuesday 9 September 2025

cuong.nguyen

Friday 21 November 2025

Share on:

Post views: 1271

Categories

Blog

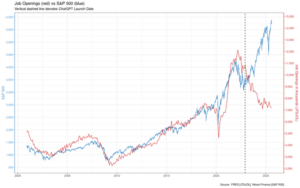

Well, there you have it everyone. Nvidia beat their earnings, (Revenue: $57.01 billion(est $54.92 billion), up 62%, EPS: $1.30(est $1.25)). Unfortunately, this only briefly helped the markets. The rally was short lived, and we saw bleeding across the board. Stocks, cryptocurrency, and ETF’s were all in the red, and it seems the sentiment has shifted. We are now in a time of extreme fear, and the markets are reacting accordingly.

With that out of the way, let’s take a look at the bearishNVDA put trade we put out Wednesday before their earnings report.

With that out of the way, let’s take a look at the bearishNVDA put trade we put out Wednesday before their earnings report.

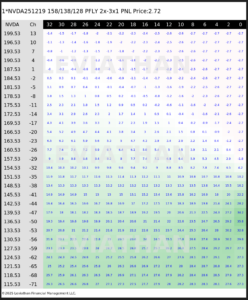

For our parameters, which was a 150 strike expiring 12-19, the best trade we found was a 158/138/128 Put Fly, 2x-3x1

When we put our report out, the cost of that trade was 2.72. Now, only two days later its already up to 3.92 and climbing.

For our parameters, which was a 150 strike expiring 12-19, the best trade we found was a 158/138/128 Put Fly, 2x-3x1

When we put our report out, the cost of that trade was 2.72. Now, only two days later its already up to 3.92 and climbing.

This situation is one of the main reasons we put out the plays that we do. We ARE NOT targeting the initial knee-jerk reaction from the earnings report, and we don’t often use short expiry options. We are more interested in capturing the trend that follows, which is why we chose the parameters we did. And even with the spike after earnings, it was never out-the-money enough that an exit was necessary and is already looking good.

This situation is one of the main reasons we put out the plays that we do. We ARE NOT targeting the initial knee-jerk reaction from the earnings report, and we don’t often use short expiry options. We are more interested in capturing the trend that follows, which is why we chose the parameters we did. And even with the spike after earnings, it was never out-the-money enough that an exit was necessary and is already looking good.

With bubble fears and shifting sentiment, investors need to protect themselves. Instead of panicking and selling off, you can take the opportunity to capitalize on the fear of others, and make yourself money.

With bubble fears and shifting sentiment, investors need to protect themselves. Instead of panicking and selling off, you can take the opportunity to capitalize on the fear of others, and make yourself money.

cuong.nguyen

Tuesday 9 September 2025

cuong.nguyen

Friday 19 September 2025

0

Comments (0)