Darren Krett

Wednesday 22 February 2023

Morning Report Feb 22nd

0

Comments (0)

cuong.nguyen

Tuesday 22 April 2025

Share on:

Post views: 2650

Categories

Blog

After a brief break for Easter weekend we are back & the markets are in full swing. With this, Tesla has a much-anticipated earnings report coming out tomorrow, April 22nd. Due to recent volatility, inconsistent sales revenue and political uncertainty, this report will be an important indicator for investors. The point of these posts are to help you, regardless of whether you are bullish or bearish on Tesla, you make that particular call, but here we have absolute best trades for each side, for investors to maximize profits while minimizing risk, regardless of direction, thats what the AI system picks out from over a billion different possible combinations.

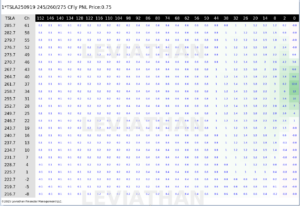

On the bullish side an investor may seek a strike of around 260, assuming there is good news from the earnings report. The trade we have is a 09-19-25 expiration, the 245/260/275 Call Fly, shown below

![]

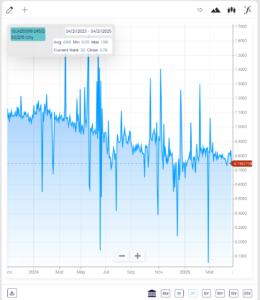

Historically, the cost of this trade is higher as of late, however going back further one can see this trade is cheaper now than it typically would have been over the last two years

![]

Historically, the cost of this trade is higher as of late, however going back further one can see this trade is cheaper now than it typically would have been over the last two years

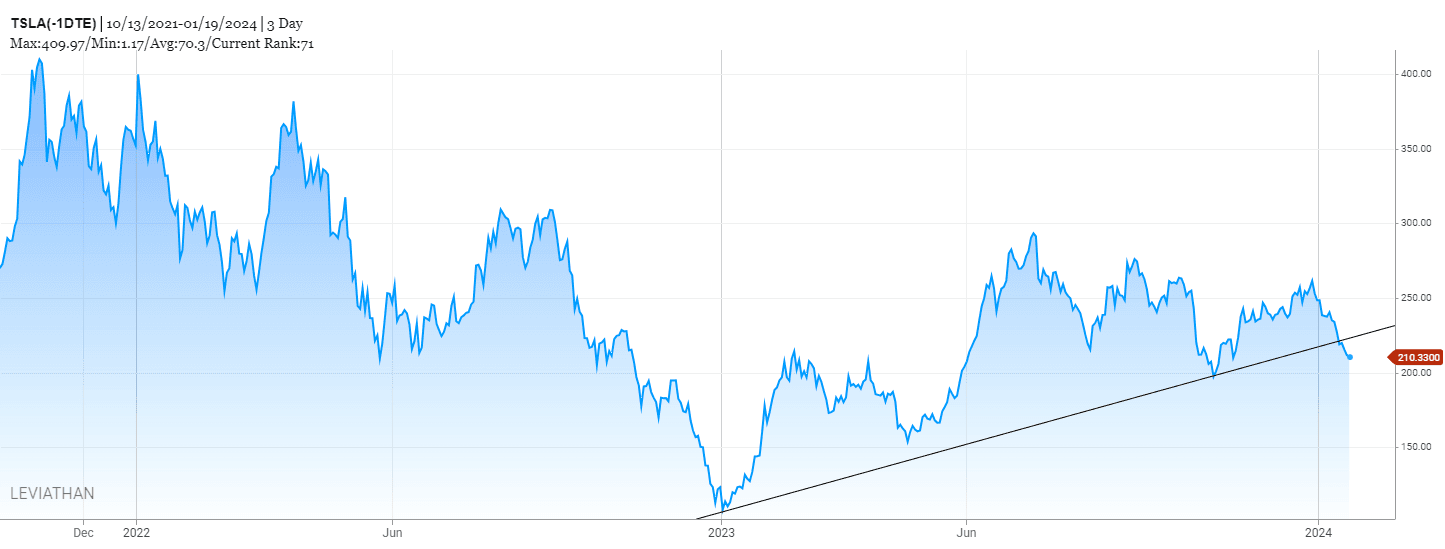

Tesla is a very volatile stock, as it if often influenced by many different factors outside of the business itself. This includes reactions to social media, global news, and lawsuits. The price has a large range, ranging from below $125 to slightly above $475 in the past two years. This range is shown below

Tesla is a very volatile stock, as it if often influenced by many different factors outside of the business itself. This includes reactions to social media, global news, and lawsuits. The price has a large range, ranging from below $125 to slightly above $475 in the past two years. This range is shown below

The heatmap of the trade shows investors how their trade will perform over time & how they would profit/lose depending on how the underlying moves, for this trade, the heatmap shows strong expected returns, while limiting downside risk. This is shown below.

The heatmap of the trade shows investors how their trade will perform over time & how they would profit/lose depending on how the underlying moves, for this trade, the heatmap shows strong expected returns, while limiting downside risk. This is shown below.

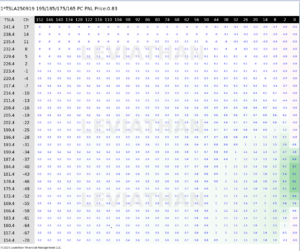

On the bearish side, an investor may seek a strike of around 180. The trade we found is a 195/185/175/165 Put Condor, also expiring 09-19-25

On the bearish side, an investor may seek a strike of around 180. The trade we found is a 195/185/175/165 Put Condor, also expiring 09-19-25

Historically (on a constant maturity basis) , the cost of this trade falls relatively in the middle of how much it would have cost over the last two years.

Historically (on a constant maturity basis) , the cost of this trade falls relatively in the middle of how much it would have cost over the last two years.

The heatmap for this trade shows the potential for strong returns while effectively minimizing downside risk. This is shown below:

The heatmap for this trade shows the potential for strong returns while effectively minimizing downside risk. This is shown below:

In conclusion, Tesla is and has been a very volatile and the general state of the markets does not help. There are debates as to whether it is over or undervalued, and whether the price will continue to rise as it has historically, or if the economic turmoil and changing customer sentiment will bring in a new reality for the company. Which direction it will go is up for you to decide, we just provide the best trades for each outcome.

In conclusion, Tesla is and has been a very volatile and the general state of the markets does not help. There are debates as to whether it is over or undervalued, and whether the price will continue to rise as it has historically, or if the economic turmoil and changing customer sentiment will bring in a new reality for the company. Which direction it will go is up for you to decide, we just provide the best trades for each outcome.

And remember…at the end of the day, its better to be lucky than good so as always, good luck.

Darren Krett

Wednesday 22 February 2023

0

Comments (0)

Darren Krett

Tuesday 23 January 2024

0

Comments (0)