Darren Krett

Tuesday 31 January 2023

The Rules of Financial Trading

0

Comments (0)

Stay ahead and keep your mind focused.

Categories

Learning

Artificial Intelligence (AI) has been transforming numerous industries for many years, and the financial sector is no exception. In recent times, AI has been actively and effectively employed in the options trading industry to help traders make better, data-driven decisions. In this article, we will explore how AI is changing the options trading industry, from forecasting to risk management.

Forecasting

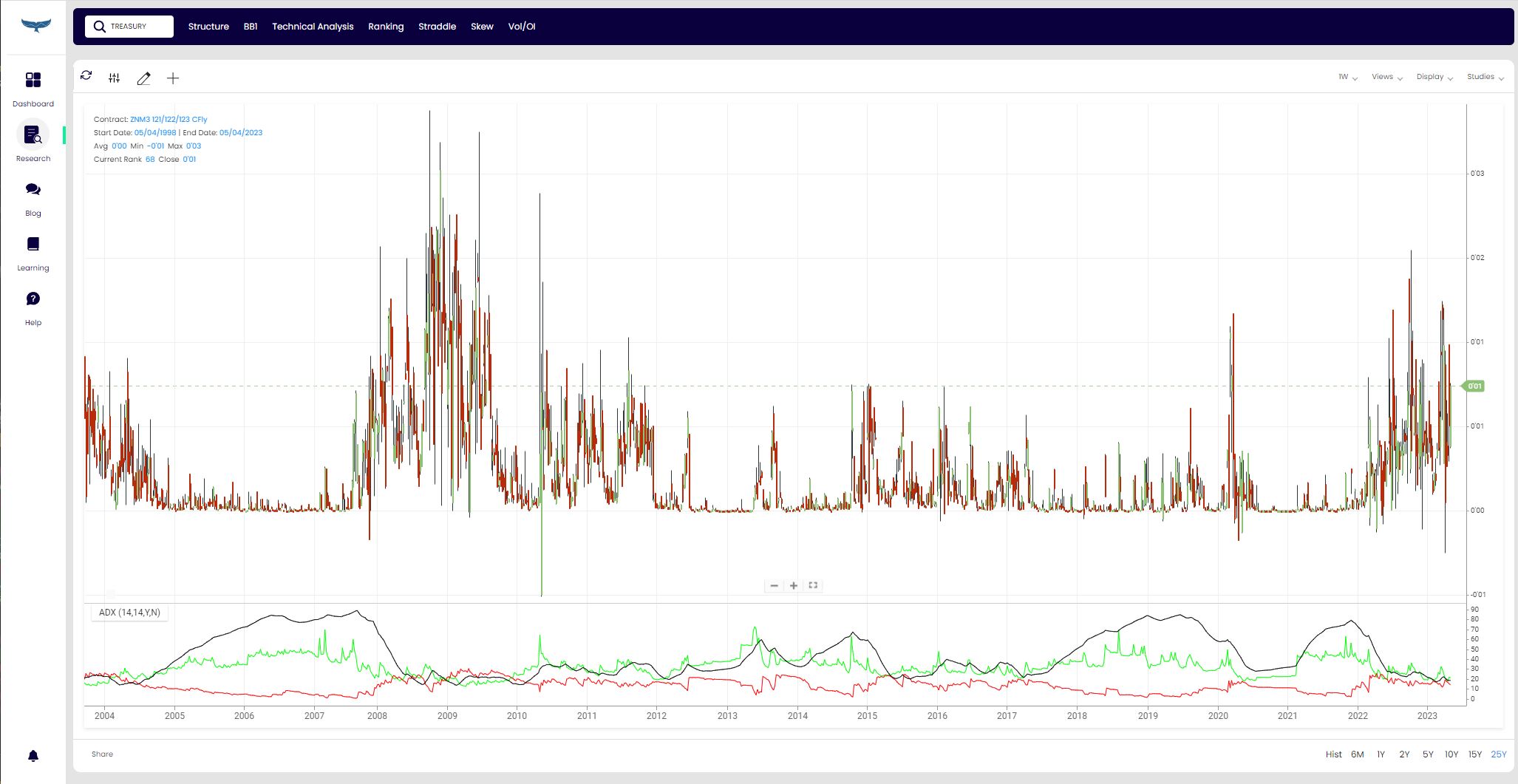

One of the primary ways AI is changing the options trading industry is by helping traders make more accurate market predictions. AI-based algorithms analyse more raw data points at incredible speeds than any human could, and they can do this 24/7. By using machine learning techniques, AI models can learn from historical data, past trading behaviours, and external variables to develop predictive models and identify valuable trading opportunities.

Risk Management

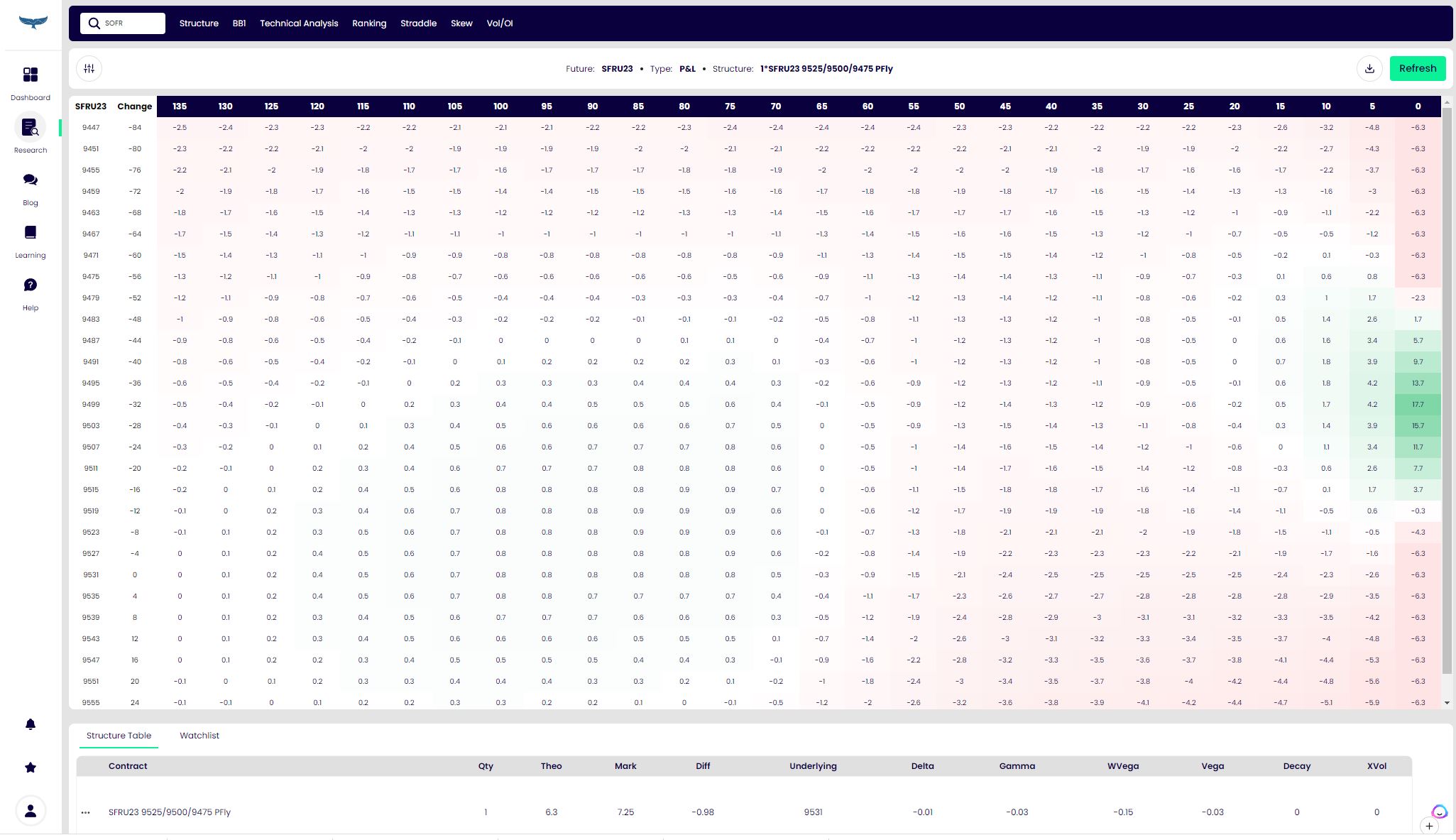

AI is also helping traders better manage risk in their options trading activities. By using sophisticated algorithms, AI models can scrutinise market activity and stress test strategies accordingly. AI-based risk management tools help you instantaneously show you and help you understand where your exposure really is.

AI is also helping traders better manage risk in their options trading activities. By using sophisticated algorithms, AI models can scrutinise market activity and stress test strategies accordingly. AI-based risk management tools help you instantaneously show you and help you understand where your exposure really is.

Increasing Efficiency

AI also gives traders the ability to analyse trades in fractions of a second, enabling faster decision making. This means that traders can quickly enter or exit the market based on real-time data, which makes it easier to take advantage of price movements that could otherwise be missed. AI-based algorithms can also help traders identify mispricings and arbitrage opportunities in a fraction of the time it would take a human trader, giving them a competitive edge.

Conclusion

AI is playing a significant role in the options trading industry, and it's changing the way traders make decisions. With AI-based algorithms analysing massive amounts of data, identifying valuable opportunities, and managing risk in real-time, traders can make better-informed decisions and improve their profitability. With AI's help, traders can be more agile and efficient in their trading activities, making the options trading industry more accessible than ever before.

Darren Krett

Tuesday 31 January 2023

0

Comments (0)

Darren Krett

Friday 10 February 2023

0

Comments (0)

Get ahead of the wave and sign up to our socials to get access to exclusive offers, videos, tutorials and latest news.

© 2015 - 2026 Leviathan Financial Management LLC. All Rights Reserved.

Legal Disclaimer: The information provided in the Leviathan website is for informational purposes only. It should not be considered legal or financial advice. You should consult with a financial advisor professional to determine what may be best for your individual needs. Leviathan Financial Management does not make any guarantee or other promise as to any results that may be obtained from using our content. No one should make any investment decision without first consulting his or her own financial advisor and conducting his or her own research and due diligence. To the maximum extent permitted by law, Leviathan Financial Management disclaims any and all liability in the event any information, commentary, analysis, opinions, advice and/or recommendations prove to be inaccurate, incomplete or unreliable, or result in any investment or other losses. Content contained on or made available through the website is not intended to and does not constitute legal advice or investment advice. Your use of the information on the website or materials linked from the Web is at your own risk.