Darren Krett

Wednesday 7 June 2023

CALL OPTIONS

0

Comments (0)

Darren Krett

Thursday 8 June 2023

Share on:

Post views: 21833

Categories

Option Strategies

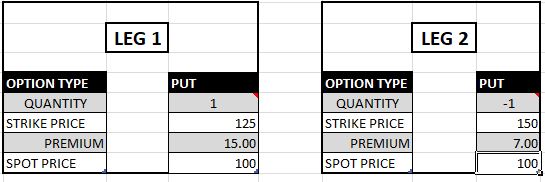

A Call Spread is an options strategy in which equal number of Call option contracts are bought and sold simultaneously on the same underlying security but with different strike prices.

Call spreads limit the option trader's maximum loss at the expense of capping his potential profit at the same time. In simple terms, you pay a cheaper Premium for less payout if right. The max profit will be the difference between the two strike prices, less the premium paid. The downside for a call spread buyer remains the premium paid.

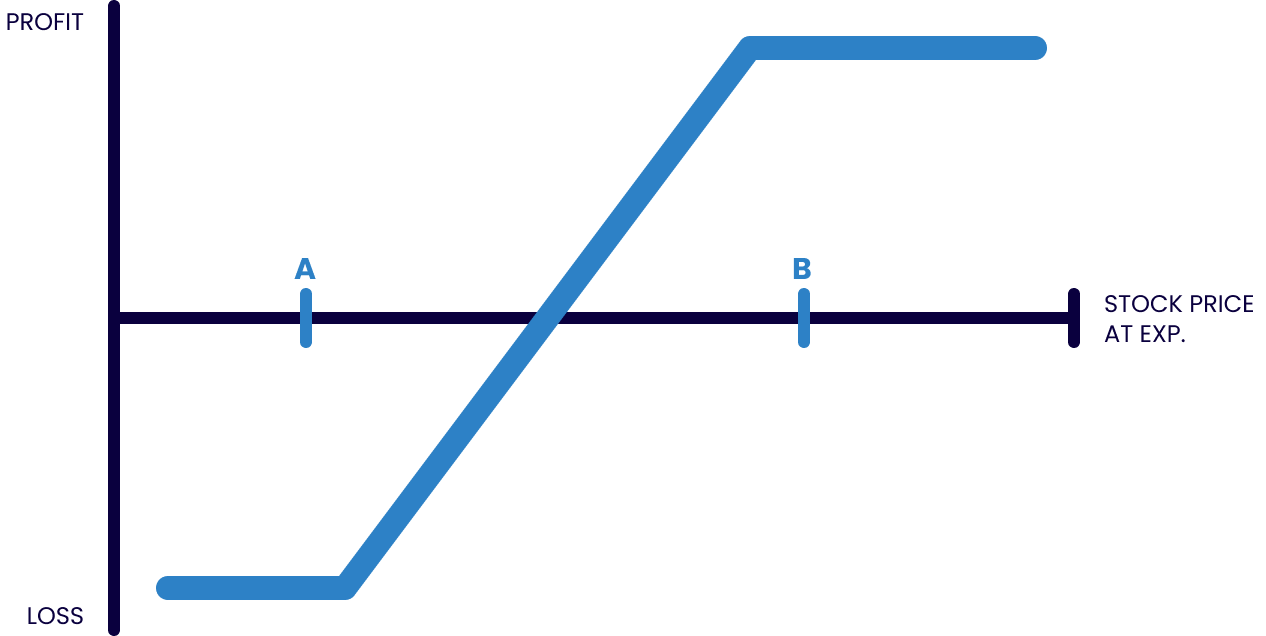

A call spread purchase is when you buy a LOWER strike and sell a HIGHER strike, the Profit & Loss graph will look like this;

There are places that refer to these spreads as bull or bear spreads, this is because how call and put spreads can mirror each other. EG: buying a call spread is EXACTLY the same as selling a put spread (assuming you use the same strikes) So these are referred to as BULL SPREADS

Conversely, if you sell a call spread, it is EXACTLY the same as buying a put spread (assuming you use the same strikes) These are referred to as BEAR SPREADS

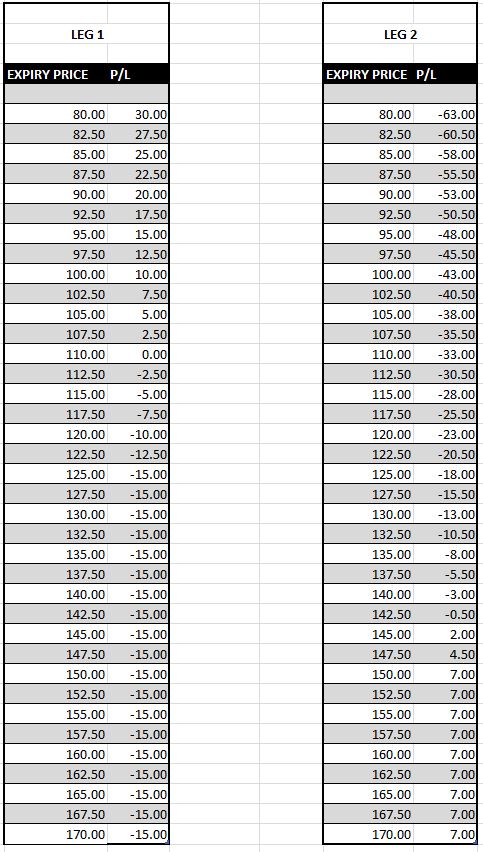

Throughout the learning section I will advise you to manually do an expiration Profit & Loss table. This allows you to visualize exactly what it is that you are doing and is something all beginner traders do to start learning about strategies.

YOU then just need to work out each individual leg profit and loss then net it out in a graph

Why these terms?

BULL is used when we think something is going UP and BEAR when we think it is going DOWN

Why these terms?

BULL is used when we think something is going UP and BEAR when we think it is going DOWN

Darren Krett

Wednesday 7 June 2023

0

Comments (0)

Darren Krett

Thursday 8 June 2023

0

Comments (0)