Darren Krett

Thursday 8 February 2024

LEVIATHAN TUTORIAL

0

Comments (0)

cuong.nguyen

Wednesday 19 November 2025

Share on:

Post views: 1437

Categories

Blog

Options Plays for NVDA Earnings and Beyond

It’s time to sound the alarm, but you must not panic. Well maybe panic a little bit but keep it together, there’s money to be made or saved.

The AI boom has led the way for the charging bull S&P 500 which recently hit all time highs on what some have referred to as the great AI CIRCLE JERK.

What is the term "circle jerk," when applied to business? It refers to a self-reinforcing, circular system designed to mutually boost the status or, more often, the financial metrics of the participants. Its a closed feedback loop intended to fool outsiders.

What is the term "circle jerk," when applied to business? It refers to a self-reinforcing, circular system designed to mutually boost the status or, more often, the financial metrics of the participants. Its a closed feedback loop intended to fool outsiders.

In finance, this practice is called "Round-Tripping," and it is a form of fraud used to mutually inflate valuations by making companies look like they are doing much more business than they actually are. The practice is often considered a type of securities fraud due to its market manipulative nature.

The Goal: To artificially pump up revenue numbers, achieve an astronomically high valuation, and then use that valuation to raise real, hard cash from investors.

In finance, this practice is called "Round-Tripping," and it is a form of fraud used to mutually inflate valuations by making companies look like they are doing much more business than they actually are. The practice is often considered a type of securities fraud due to its market manipulative nature.

The Goal: To artificially pump up revenue numbers, achieve an astronomically high valuation, and then use that valuation to raise real, hard cash from investors.

The Simple Mechanics:

Imagine three companies (A, B, and C) that have no real customers. They pass the same $100 bill around:

The Simple Mechanics:

Imagine three companies (A, B, and C) that have no real customers. They pass the same $100 bill around:

Company A pays Company B $100. Company B pays Company C $100. Company C pays Company A $100.

Result: All three companies now report $100 in revenue. Using the high multiples common in the markets, they can suddenly claim a combined paper value of thousands of dollars, ready to attract major investment.

Now while some see these evaluations as a good thing, there is a major underlying problem, being that more jobs are not being created. As mentioned by Powell there has been nearly zero job creation currently. Companies are realizing that they can effectively replace employees with automation and AI programs, reducing costs and boosting profits.

This is an unsustainable model long term, and some have already begun calling it out as such.

Now while some see these evaluations as a good thing, there is a major underlying problem, being that more jobs are not being created. As mentioned by Powell there has been nearly zero job creation currently. Companies are realizing that they can effectively replace employees with automation and AI programs, reducing costs and boosting profits.

This is an unsustainable model long term, and some have already begun calling it out as such.

Now with the news that Peter Theil has sold his ENTIRE holding of NVDA and Baron Trump’s purchase of $10mil worth of puts in the S&P, it might be time to lighten the load.

Now with the news that Peter Theil has sold his ENTIRE holding of NVDA and Baron Trump’s purchase of $10mil worth of puts in the S&P, it might be time to lighten the load.

Even if NVDA hits its mark, we may see a relief rally in the short term, but that does not mean we are in the clear. It seems that consumer sentiment is shifting, and more people are losing faith and trust in the markets.

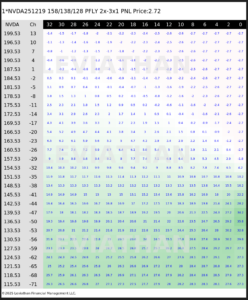

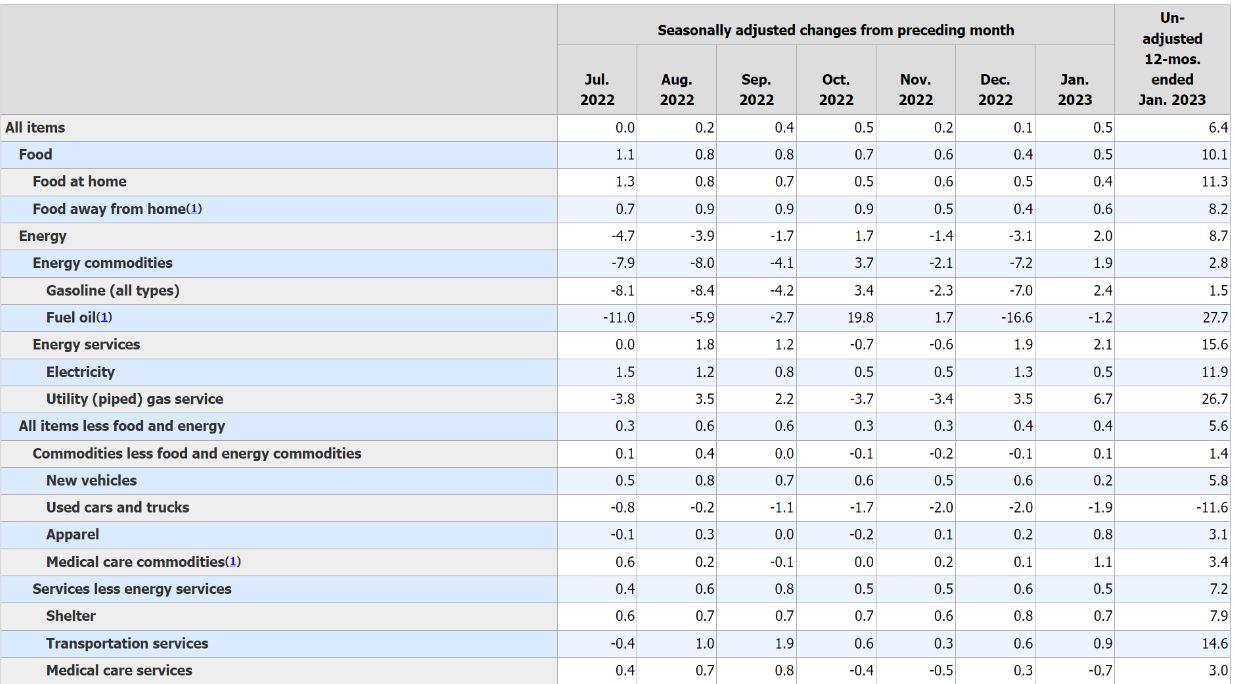

On that note, we looked at the downside of NVDA, and explored how one can protect themselves against a downward movement. In doing this, we looked for trades that expired 12-19, and had a strike of 150. This gave us two ideal options, the first being a 158/144 Put Spread, and the other one being a 158/148/138 Put Fly. They both offer strong returns and limit downside risk. Where they differ is in risk-reward. The put spread is cheaper and offers up top 12 times returns while the put fly is more expensive and carries more downside risk but offers up to 27 times returns.

Below is the Put Fly

This graph from Leviathan shows the cost of the trade historically, which has fluctuated a lot, but currently it gives strong value.

This graph shows the price of the NVDA, showing strong growth and how it is near its all-time highs.

This heatmap shows the profitability of this trade. We like it because there is very limited downside risk, yet the potential for a huge profit. Additionally, we like that it monetizes immediately, giving more freedom, rather then being stuck within a specific and short time frame to be a winner.

SO, now that we are back…. lets see what happens next and as I always say, better to be lucky than good, so best of luck to you all.

Darren Krett

Thursday 8 February 2024

0

Comments (0)

Darren Krett

Tuesday 14 February 2023

0

Comments (0)