cuong.nguyen

Tuesday 29 April 2025

Option Plays for META Earnings and Beyond

0

Comments (0)

cuong.nguyen

Wednesday 7 May 2025

Share on:

Post views: 2609

Categories

Blog

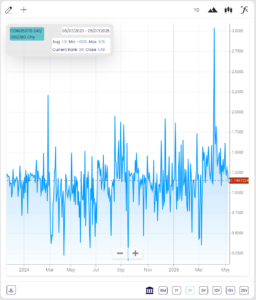

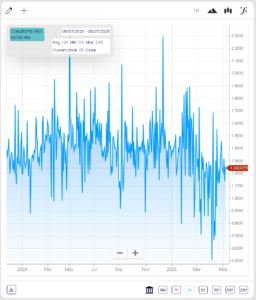

Continuing this week of earnings, anpother one to watch comes from Coinbase(COIN). This equity has ranged from $142 to $349 on the past year. I like that for the purposes of what we do, which is using options to profit on volatility. I cannot say which way it will move, as there are many more factors currently at play than in typical market conditions, but there is money to be made each way.

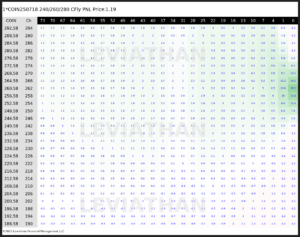

First, for you bulls out there we found a 240/260/280 Call Fly, expiring in July

The cost of this trade is slightly above average but well within the ideal range we are looking for.

The value of the underlying equity, COIN, is way up over the last couple years, but is well below its December all-time high. Even with the uncertainty in US and global markets, there is still a lot of upside value at this price. Additionally, Kenneth Worthington at JP Morgan has a price prediction of $276 by the end of 2025, further indicating growth will likely occur.

The heatmap of this trade shows the profitability, and while it’s not my favorite strategy (I prefer put/call spreads vs fly’s or condors, mostly because of the minimized risk and immediate profitability) it still monetizes quickly, and, If the underlying moves up and a trader (you) holds until expiration, the potential return is absurdly large.

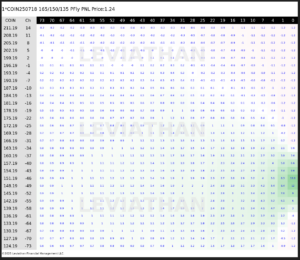

On the flip side, for you bears out there, don’t worry we didn’t forget about you. While many are bullish, there are some notable organizations who are bearish. Specifically, Barclays, who have an end-of-year price estimate of $169. To capitalize on this potential downward movement, we found a 165/150/135 Put Fly, expiring in July

On the flip side, for you bears out there, don’t worry we didn’t forget about you. While many are bullish, there are some notable organizations who are bearish. Specifically, Barclays, who have an end-of-year price estimate of $169. To capitalize on this potential downward movement, we found a 165/150/135 Put Fly, expiring in July

The cost of this trade is below average compared to what it has been the past couple years, giving investors a lot of value and upside potential, with minimal risk.

The heatmap of this trade shows the profitability, and despite it not being fly and not a spread, it monetizes relatively quickly, and offers a very strong ROI on downward movement of the equity if held to expiration

In conclusion, Coinbase (Coin) is a hot stock that merits watching closely. It has strong fundamentals, yet it too is subject to the uncertainty plaguing the markets. I cannot say which direction it will move, as each of you need to determine that for yourselves, but once you figure that out, these are two of the best trades one can make to maximize profitability while simultaneously minimizing risk (limiting risk to premium cost only).

cuong.nguyen

Tuesday 29 April 2025

0

Comments (0)

cuong.nguyen

Tuesday 6 May 2025

0

Comments (0)