cuong.nguyen

Tuesday 29 April 2025

Option Plays for META Earnings and Beyond

0

Comments (0)

cuong.nguyen

Tuesday 20 May 2025

Share on:

Post views: 2270

Categories

Blog

As we progress through another slow week of earnings reports, one noteworthy one comes from Target (TGT) Wednesday before the markets open. Target has struggled recently, as their foot traffic has been on a steady decline for the last 10 weeks, and they are being wrecked by their competitors, Walmart, Amazon and Costco. Additionally, their customer spending is falling.

Despite the above, there are still some bulls when it comes to ZTGT. Most notably, BofA still has a strong buy rating on it, with a price target of $145 per share. Additionally, Joseph Feldman from Telsey Advisory Group changed his price target from $145 to $130, however they reiterated their buy rating.

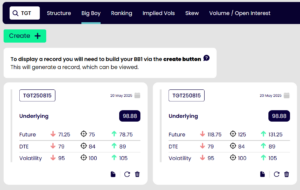

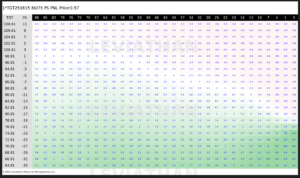

Using our AI program to isolate the best risk/reward trades, we found the best trades for both sides. All we do is input the strikes we want(125,75) and the expiration(0815) and it finds the best trades.

First, for you bulls out there, we found a 115/120 Call Spread, expiring in August.

The cost of this trade is slightly above average, but still cheap and well within our ideal range, showing strong value.

The cost of this trade is slightly above average, but still cheap and well within our ideal range, showing strong value.

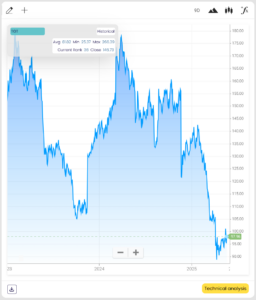

Historically, the price of target is down. It down massively from its summer 2021 highs, and is currently still reeling from the tariff news. It has tried to move positively, but is struggling to do so. That being said, with the volatility in the markets currently, it’s safe to say it wouldn’t take much to shift consumer sentiment and move investors back into the equity.

The heatmap of this trade shows how it is profitable, and what we like the most is it monetizes immediately upon a positive movement in the price, so investors do not have to wait till near expiration to cash in. Additionally, the risk is limited to premium only, making this another trade which loses small but wins big.

The heatmap of this trade shows how it is profitable, and what we like the most is it monetizes immediately upon a positive movement in the price, so investors do not have to wait till near expiration to cash in. Additionally, the risk is limited to premium only, making this another trade which loses small but wins big.

On the flip side, for you bears out there, using a strike of 75, we found an 80/75 Put Spread, also expiring in August.

On the flip side, for you bears out there, using a strike of 75, we found an 80/75 Put Spread, also expiring in August.

The cost of this trade is slightly above average but at .57c it is still cheap and well within our ideal range.

The cost of this trade is slightly above average but at .57c it is still cheap and well within our ideal range.

The heatmap of this trade shows that it also monetizes immediately (being a spread), and gives strong returns with minimal risk. The risk here, again, is limited to premium only, making this another trade that loses small but wins big.

The heatmap of this trade shows that it also monetizes immediately (being a spread), and gives strong returns with minimal risk. The risk here, again, is limited to premium only, making this another trade that loses small but wins big.

In conclusion, no one knows which way Target, or any stock will move. That being said, there are cases to be made on either side. I personally am more on the bearish side based on their financials and because they are getting out-performed by competitors but at the end of the day, anything can happen, especially in these markets. Trust your own analysis and use it to take advantage of the trades we provide to maximize your potential returns, while simultaneously minimizing your downside risk.

And as always, it’s better to be lucky than good so good luck to you all.

cuong.nguyen

Tuesday 29 April 2025

0

Comments (0)

cuong.nguyen

Tuesday 6 May 2025

0

Comments (0)