cuong.nguyen

Tuesday 29 April 2025

Option Plays for META Earnings and Beyond

0

Comments (0)

cuong.nguyen

Tuesday 6 May 2025

Share on:

Post views: 5676

Categories

Blog

Hey everyone, continuing our week of highly anticipated earnings, we have Uber. Their report comes before market open on Wednesday, and offers investors a great opportunity to make some money.

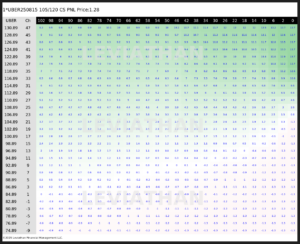

Most expert analysists are bullish on Uber, yet in this economic climate, quite literally anything can happen. When it comes to option trading strategies for this equity, our main goal is to find trades that offer strong returns, while minimizing downside risk. On that note, the trade for the upside we found is a 105/120 Call Spread, expiring in August.

The cost of the trade is slightly higher than its historical average with a Theo(cost) of 1.28, but still within range that provides strong value

The price of the underlying equity(UBER) is near its all time high, but continues to show strong growth, despite an increase in competition.

The heatmap of this trade shows profitability, and what we like the most is that because the strategy is a call spread, it monetizes almost instantly upon the correct movement in the underlying, meaning an investor does not have to hold the contracts until expiration to make a good return. Additionally, the risk is limited to the premium paid, protecting investors from huge losses.

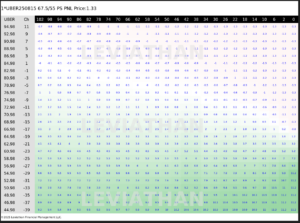

On the flip side, the best trade we found on the downside is a 67.5/55 Put Spread, also expiring in August

The cost of this trade is also in the higher side, with a Theo of 1.33, but still remains well within the ideal range.

The heatmap of this trade shows profitability, and shows how quickly this trade monetizes upon the correct movement of the underlying. An investor does not have to hold all the way until expiration to get a strong return. Also, following our ideal strategy, the downside risk is limited to premium only, protecting investors from huge losses.

In conclusion, the upcoming UBER earnings report offers investors a fantastic opportunity to make some money. Whether you are bullish or bearish, the trades we are providing here give strong returns while minimizing downside risk. Do your own analysis, determine which way you believe the price will move, and place your trades accordingly.

And as always, remember it’s better to be lucky than good, so good luck to you all.

cuong.nguyen

Tuesday 29 April 2025

0

Comments (0)

cuong.nguyen

Monday 5 May 2025

0

Comments (0)