cuong.nguyen

Tuesday 29 April 2025

Option Plays for META Earnings and Beyond

0

Comments (0)

cuong.nguyen

Monday 5 May 2025

Share on:

Post views: 4449

Categories

Blog

AMD Earnings

Starting May strong, we have another eventful week of earnings reports coming. One of the most interesting will come from AMD, Advanced Micro Devices. Personally, I am bullish on this one but with all the uncertainty plaguing US and global markets, there is an easy case to be made for movement in either direction.

The being said, for all you bulls out there, we like a target of 140 on the upside. This comes from multiple analysts at Piper Sandler, BOCOM, First Shanghai Securities, Fubon Securities, Roth Capital, and Raymond James.

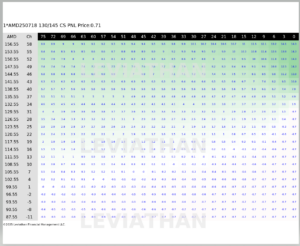

Using this strike, the best trade we found is a 130/145 Call Spread, expiring in July.

The cost of this trade is right around its average over the past couple years, and with the projected returns, this offers strong value to investors.

The cost of this trade is right around its average over the past couple years, and with the projected returns, this offers strong value to investors.

The historical price of the underlying equity has shown a strong pattern of growth but is down a lot from its March 2024 all time high. With a strong earnings report, AMD has a high upside potential.

The heatmap for this trade shows profitability, and in this case shows how the trade monetizes very quickly and has a large range where it is in the money. Additionally, it shows the downside risk is limited to premium only, protecting investors from exposure to negative movements.

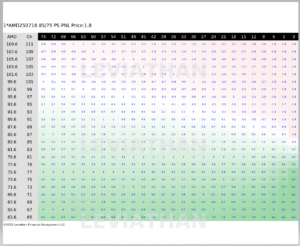

On the flip side, for you bears out there, with the target strike of 70 from Frank Lee at HSCB, we found the following 85/75 Put Spread, expiring July 18th.

The cost of this trade is right on par with its average over the last couple years, also giving it strong value for investors.

The heatmap of this trade shows strong profitability and risk limited to premiums, making this a low-risk, high-reward trade that becomes profitable immediately, assuming a downside move. (Don’t worry about the red, it maxes out at -$1.80, the premium)

In conclusion, the highly anticipated earnings report from AMD comes out after market close on Tuesday. This is a fantastic opportunity for investors to profit on movement, whether that is positive or negative. I am not a genie with a crystal ball, and cannot see the future, so direction, each of you must choose yourself, however with the trades provided, direction is the only choice you need to make on your own.

And as always, its better to be lucky than good, so good luck to you all.

cuong.nguyen

Tuesday 29 April 2025

0

Comments (0)

cuong.nguyen

Wednesday 30 April 2025

0

Comments (0)